The value of Australian exports to the US, including steel products, is lower than the reciprocal figure. Photo: BlueScope

THE UNITED States’ trade surplus with Australia has so far helped keep Australian agricultural exports off the “wheel of misfortune” when it comes to the new wave of US tariffs, Rabobank says in a global report.

Entitled The impact of US tariffs on global food and agribusiness , the report by the bank’s RaboResearch division identifies Australia as one US trade partner likely to be at the lowest risk of future direct tariffs, due to the balance of trade between the two countries being in favour of the US.

The report explores trade policies and tariffs from Donald Trump’s second presidency, and their potential global impacts on food and agriculture, and identifies nine waves of economic and geopolitical measures that have been imposed, are coming, or are likely under the current US administration.

These range from the first wave announced by the Trump administration against Colombia, a major supplier of coffee and cut flowers to the US, to the latest on US steel and aluminium imports, which may disrupt supply or increase costs for beverage and food packaging.

Their effects are already starting to be felt outside the US, according to report co-author, RaboResearch general manager Australia and New Zealand Stefan Vogel, and their potential impacts on global food and agribusiness range from minor ripple effects to heavy disruptions.

“It has been a stormy start to the year with many waves and more to be expected later in 2025,” Mr Vogel said.

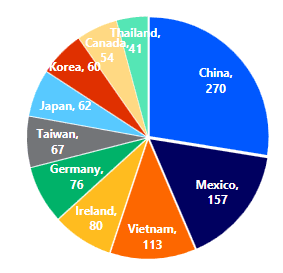

Graph 1: US top 10 trade deficits in $US billions over Jan-Nov 2024. Source: US Census Bureau, RaboResearch 2025

The report says countries such as China, Mexico and Canada which have significant trade surpluses with the US, meaning they export more to the US than they import from it, face a higher risk of further tariffs, which could lead to increased costs and disruptions in global trade.

“President Trump has stated many times that he is especially targeting countries with whom the US holds a heavy trade deficit.

“China and Mexico are top on that list, but Canada also makes the list of the top 10 countries with whom the US has a trade deficit.

“EU countries also make up a large share as do various Asian economies.”

Ag exports loom large for Australia

While Australia is in a more favourable position in terms of its overall balance of trade with the US when it comes to potential tariff risks, the US is a significant market for some Australian agricultural exports, including beef, lamb, and wine.

“Australia’s beef sector has seen the US emerge as its largest buyer in recent months,” Mr Vogel said.

“US tariffs would hurt this trade flow, which accounted for approximately 30 percent of all Australian beef exports in 2024 – the equivalent of 23pc of Australia’s beef production – while 23pc of US beef imports were supplied by Australia.

“This made Australia, together with Canada, the largest beef exporters to the US, well ahead of Mexico, Brazil and New Zealand.”

Besides beef, Mr Vogel said, almost 25pc of Australian sheepmeat exports in 2024 went to the US, making it Australia’s largest sheepmeat trade partner, ahead of China.

The US is also an important destination for Australian wine.

Nine waves around the world

The report says current US policy is using tools of “statecraft”, such as tariffs, to achieve wider political goals and, in doing so, is creating “waves that are hitting shores abroad”, with food and agribusiness sectors likely to see wide-ranging impacts across the globe and along the entire supply chain.

The nine waves and some potential impacts on global food and agriculture include:

- Colombia: significant impacts for US imports of cut flowers and coffee;

- Mexico and Canada: 25pc tariffs on most goods, along with a 10pc tariff on Canadian energy imports. Could heavily impact energy sector and agricultural supply in North America, increasing costs;

- China: a 10pc tariff imposed on Chinese goods. Retaliatory measures from China have been put in place, but do not yet affect major US agricultural exports like soybeans;

- Ukraine: to ensure continued financial and military support, a US-Ukraine deal that would give the US access to Ukraine’s vast supplies of rare earths including lithium is in the final stages;

- Houthis: Recent US pressure on the Houthi rebels active in the Red Sea and Suez Canal, and the

- Hamas-Israel ceasefire agreement have seen the Houthis announce they would cease attacks on most vessels in the canal;

- Panama Canal: Trump has expressed a desire to take back control of the canal, a crucial shipping route for US trade. This could have significant implications for global maritime agricultural trade;

- Europe: the EU may face US tariffs on products, including machinery and pharmaceuticals as well as spirits, wine and agricultural goods;

- US Agency for International Development: funding cuts have impacts for agriculture, with the agency, which administers foreign aid and development assistance, having purchased US$2 billion in US-grown crops in 2024; and,

- Steel and aluminium tariffs: increased US tariffs on steel and aluminium may disrupt supply and increase packaging costs for food and beverage.

Australian imports from the US are headed by machinery and boilers, which were valued at $6.71B in 2024, vehicles at $5.05B, electrical and electronic equipment at $3.9B, aircraft and spacecraft at $2.73B, optical, photo, technical, and medical apparatus at $$2.6B, and pharmaceutical products at $2.38B.

Source: Rabobank

HAVE YOUR SAY