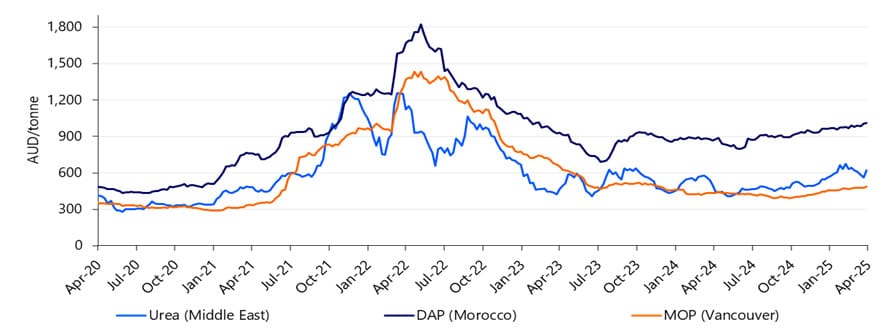

Figure 1: Key urea, DAP and MOP prices from April 2020 to April 2025. Source: CRU, Macrobond, RaboResearch 2025.

GLOBAL urea supplies are in a fragile state, with several key suppliers exporting lower volumes year on year, creating a ripple effect for volume available to Australian fertiliser importers, Rabobank says in a newly-released report.

The agribusiness banking specialist said urea was by far the most widely-traded fertiliser in the world, represented 46 percent of Australia’s total 2024 fertiliser imports.

In its What tight urea supplies mean for global prices and Australian farmers report, the bank’s RaboResearch division said Australia’s minimal volume locally produced urea made it particularly sensitive to global events.

RaboResearch analyst Paul Joules.

Report author RaboResearch farm inputs and commodities analyst Paul Joules said the urea market was expected to remain volatile due to complex supply chains and geopolitical influences, with prices elevated compared to historical averages.

“Ongoing supply issues in key exporting regions and the sensitive nature of natural gas markets – the predominant feedstock for urea production – suggest that urea prices will likely stay high,” Mr Joules said.

Given complex supply chains, Mr Joules said urea prices tend to trade with considerable volatility.

“At present, prices are trading around the five-year average.

“However, if we were to compare current prices with the pre-Russia-Ukraine war five-year average price, they are 40 percent higher.”

Mr Joules said in addition to geopolitical issues impacting fertiliser prices and availability, natural gas was the other key influence within the market.

“The sensitivity of natural gas markets to both weather and geopolitical events adds to the volatility of urea prices.”

The RaboResearch report said while the majority of the chief urea-producing regions and countries, namely Europe, Iran, Egypt, and China, that were experiencing supply issues do not directly supply Australia, they accounted for global losses to the supply.

Mr Joules said this “creates a ripple effect for available volumes for Australian importers”.

In 2024, 79pc of Australian urea imports came from the United Arab Emirates, Saudi Arabia, Qatar, Indonesia, and Oman.

Weak AUD seen

Mr Joules said although global supply and demand factors will continue to influence Australian urea prices, the other major impact is foreign exchange rates, and Rabo expected the strong outlook for the US dollar to keep the AUD weak in 2025.

“RaboResearch anticipates the Australian dollar to remain relatively weak, with the cross expected to reach 0.65 on a 12-month view.

“Ultimately, for urea and other imported goods, this means farmers will most likely continue to face a currency headwind throughout 2025.”

Mr Joules said, in terms of urea price outlook, the combination of the 12-month view of a relatively weak AUD, alongside the tight supply outlook, a call for lower urea prices for Australian farmers in 2025 was “difficult to justify”.

The bank’s base case view is for urea prices to likely remain around current elevated levels in 2025.

Reduced imports some way off

The report said Australian imported 3.85 million tonnes of urea, or more than 90 percent of its requirement, in 2024.

Mr Joules said the local farm-inputs sector was questioning whether Australia could successfully reduce its import dependence via local urea production in the near future.

“At present, there is not a definitive answer to this question; however, there are a number of ongoing projects, which make use of Australia’s natural gas resources.

“Two of the most promising projects are planned in South Australia and Western Australia.”

These are the Perdaman project in north-west WA, and NeuRizer at Leigh Creek in SA.

“Assuming these projects were both to go ahead, that would mean production would total 3.3 million tonnes.”

That figure is 550,000t short of Australia’s total 2024 urea imports.

Mr Joules said it was unlikely Australia would switch from relying largely on imported volumes to domestic supplies in the near future.

“This is due to the economics of internal shipping versus international exports.

“Freight costs from South Australia and Western Australia to agricultural regions in other states are high and, from a urea producer’s standpoint, shipping at least some volumes overseas via well-established international shipping networks, would likely be viewed as the most economically-viable option.

“At certain times of the year, high demand from South-east Asia and India could potentially absorb a sizeable amount of any Australian-produced volume, and it may well make more economic sense to export volumes abroad, as opposed to shipping to parts of Australia which are far away from the proposed plants.”

While Australia may increase internal urea production, Mr Joules said complete elimination of reliance on imports was unlikely.

“Although the proposed domestic urea projects can provide some benefits, especially during supply shocks, significantly lower prices are not anticipated solely from these proposed developments.

“Domestic urea prices are expected to align closely with global levels, as it is anticipated Australian producers will base pricing on global benchmarks.”

Mr Joules said the primary drivers for urea prices in Australia will continue to be global supply and demand factors.

Source: Rabobank

HAVE YOUR SAY