Weather: Rain in the BSEA over recent days has improved crop prospects, with some relief for parts of the US Plains. The forecast for large areas is improving over the next week. In Australia, wet conditions persist in the north, with good falls through NNSW and QLD over the weekend.

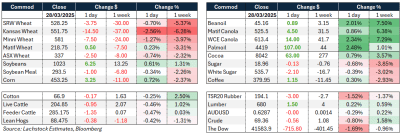

Markets: Improving weather in the BSEA and parts of the US, along with tariff talks and peace negotiations, weighed heavily on wheat all week, causing futures to close lower on Friday. Soybeans rose, driven by soybean oil, while corn also ended the week higher despite the increased acreage forecast in the Grain Stocks report due later today.

Australian Day Ahead: Canola is expected to start the week higher as global markets continue to rise, with bids anticipated to be $5-$10 higher. Wheat continues to slide globally, though local bids are supported by domestic demand. Barley demand remains solid, driven by strong export and domestic demand

.

Offshore

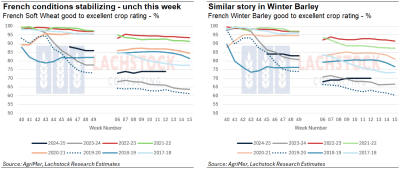

Crop ratings in France show 2024-25 conditions (dark blue lines) are poorest in past five years. Chart on left is wheat. Chart on right is barley.. Source; AgriMer via Lachstock

France’s Agriculture Ministry rated the country’s soft wheat crop at 74pc good to excellent as of March 24, maintaining the same level as the previous week. Except for the 66pc rating in 2024, this marks the poorest condition in the past five years.

Combined US production of biodiesel and HVO dropped sharply to 0.75 million tonnes (Mt) in February, down 0.4Mt (36pc) year-over-year, marking the lowest monthly output since February 2022.

State Crop Progress reports indicated that winter wheat ratings improved in Kansas by 1pc to 49pc good to excellent, while Texas saw a 3pc increase to 31pc.

Wheat bookings for the week of March 20 totalled 100,325t, up from last week’s low. Export commitments reached 21.092Mt, 93pc of the USDA’s forecast, but still behind the 101pc average pace.

Agroconsult forecasts Brazil’s 2024/25 soybean crop at a record 172.1Mt, highlighting a strong harvest in the top exporting nation.

Grain markets await today’s USDA planting and stocks report, along with details on tariffs announced by US President Trump, effective April 2. Analysts predict US farmers will plant 94.361 million acres of corn this year, up from 90.594 in 2024 with soybeans forecast to lose acres.

Donald Trump expressed strong frustration with Vladimir Putin, saying he was “pissed off” about the Russian leader’s recent remarks suggesting new leadership in Ukraine, which Trump believes would hinder peace efforts. In a phone interview with NBC, Trump said if a ceasefire isn’t reached and Russia is to blame, he would consider imposing secondary sanctions on all Russian oil exports. He also mentioned plans to speak with Putin soon. Given Russia’s role as a top global oil producer, such sanctions could significantly impact global oil markets and inflation, especially affecting key buyers like India and China who have been major importers of Russian crude since the Ukraine invasion.

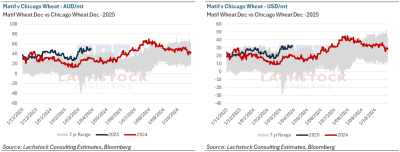

Matif versus Chicago wheat price. Left chart is denominated in Australian dollars per tonne. Right is US$/t. Source Bloomberg via Lachstock

Australia

WA canola bids were solid to end the week, with the current crop bid around A$795 and GM at $705. New crop bids were around $810. Wheat was softer, bid around $370, and barley at $355.

Through the east of the country, canola improved to be bid just shy of $800, with GM making it back to $700. The new crop conventional bid was $770. Barley was $320, and wheat was slightly softer, bid at $340.

Some good falls through NNSW, with 50-100mm over large parts. Spare a thought for those in southwestern Queensland, where widespread flooding has led to estimates of 1 million cattle lost.

Expect any canola still in growers’ hands to be sold this week while exporter demand is still there. GM bids in the Port Adelaide market zone are around $100 behind those in Victoria, with little to no export demand remaining in SA, as the small crop has already been shipped.

HAVE YOUR SAY