Weather: US Plains weather forecast is unchanged, with Arkansas, Sth Illinois, Sth Indiana set to get 10 inches across the next 5 days. HRW regions still set to receive something, more confidence for the south east part of the belt though.

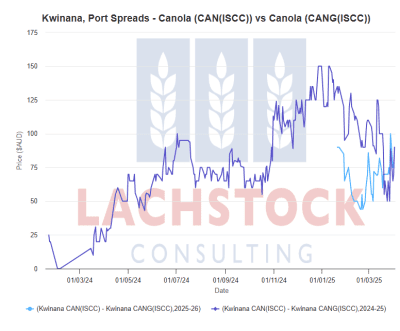

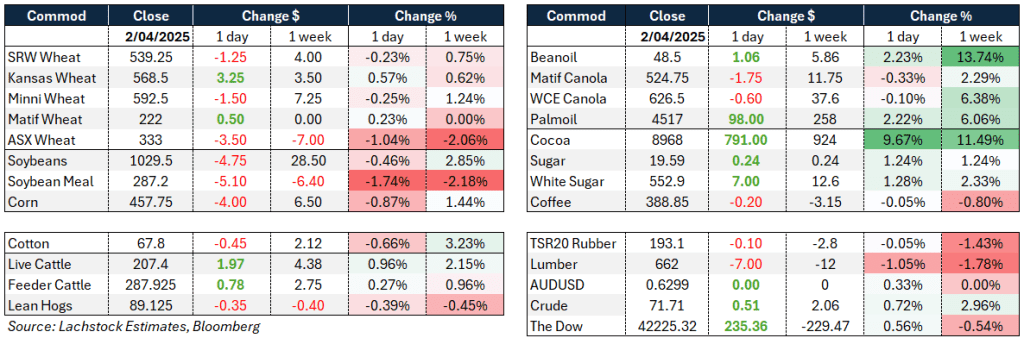

Markets: Offshore Ags will likely to be under pressure in the short-term post the “Liberation Day” widespread tariff announcements, Canola supportive until more clarity over the US bio-fuel mandate and Canadian tariffs.

Australian Day Ahead: Trade expected to remain on the defensive, we are post Donald’s address but now we wait for Europe’s and large parts of Asia and watch for retaliatory tariff developments. The AUD has traded a 100pt range just this morning, need the dust to settle a little bit here. Canola bids should be same or better.

Offshore

The headline read “It’s our declaration of independence,” and “We will establish a minimum baseline tariff of 10%”. Trump said at the White House Rose Garden event this morning. What the means for Australian products directly is a 10% across the board tariff, there was some initial fear that beef could be higher but everything we can see has beef at the 10%. Canada & Mexico were not listed on the board.

The headline read “It’s our declaration of independence,” and “We will establish a minimum baseline tariff of 10%”. Trump said at the White House Rose Garden event this morning. What the means for Australian products directly is a 10% across the board tariff, there was some initial fear that beef could be higher but everything we can see has beef at the 10%. Canada & Mexico were not listed on the board.

Ukraine’s wheat exports are expected to be around 1mmt in April, compared to 1.1mmt in March according to Ukrainian farm producers union. Last year the Ukrainian farm ministry put a cap of wheat exports for the 2024/25 marketing year of 16.2mmt to ensure enough supply for the domestic market and as at the end of March wheat exports are tracking around 13mmt.

The NASS monthly grain crushing data showed a total of 421.2mbu of corn used for ethanol production in the US during February, that is down 10% from January. The Marketing year total is at 2.754bbu of corn used for ethanol, 1.31% ahead of the same time last year.

Australia

Canola bids were firmer in WA yesterday with current crop conventional bid $800 with new crop bid $850 and GM $760. Wheat was stronger with bids $375 a similar level for old and new crop, barley was bid $355 for old crop and $336 for new crop.

In the east of the country canola new crop prices improved to around $780 Newc PZ and $790-795 track in the south.

New crop markets delivered Downs found common ground after the widespread recent rains to trade $365 sfw and $340 feed barley.

HAVE YOUR SAY