Weather: It is swings and roundabouts. Rainfall forecasts for Russia are slightly lower while the US amounts have increased overnight. The Aussie pattern is pushing further south but for SA, WA and western Vic, there is nothing on the forecast for the next 15 days.

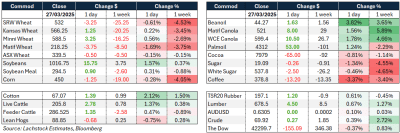

Markets: Grain markets overnight were mixed grains, vegetable oils were firm which continues the theme of the week really. Surprising strength in canola given the regulatory exposure and the inability to predict what Donald Trump might do next.

Australian Day Ahead: Grains mixed while canola continues to catch a bid. The spread between Aussie GM and Canada has blown out significantly yet the trade wants it. Northern feed grain markets will face some access issues with the rainfall which could create some short term strength but, ultimately, growers will be happy with the forecast and the new crop production prospects.

Offshore

Wheat markets remained under pressure due to a combination of weak US export sales, technical selling, and ongoing demand struggles despite US SRW being the cheapest globally. Chicago May wheat (WK) hit a new low of US526.50c, driven by spillover from bearish corn sentiment, slumping Matif futures, and broader macroeconomic concerns. Matif wheat fell sharply, and Russian cash wheat climbed to US$254, highlighting shifting global price dynamics. Record short positions persist despite tight stocks, while weather changes, such as reduced rain in HRW areas, offered brief support. Political uncertainty, particularly surrounding Black Sea tensions and new US tariffs, adds to the cautious tone in the market.

Ukraine and Russia traded accusations of violating a US-brokered truce on energy strikes, with both sides appearing far from agreement despite the announcement of separate deals. Ukraine claimed the ceasefire was immediately effective, while Russia insisted it would not take effect until a sanctioned Russian bank was reconnected to the international payment system — a condition the EU firmly rejected unless Russia withdraws from Ukraine.

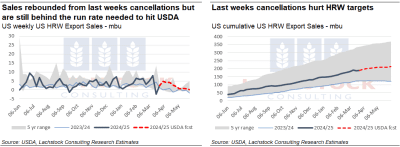

US Hard Red Winter wheat export sales. Weekly (LHS) and cumulative (RHS). Million bushels. Source: USDA via Lachstock. Click expand.

Wheat net sales were weak at 100,300 tonnes for 2024/25, well below recent averages, mainly due to large reductions from unknown destinations despite sales to Japan, Nigeria, and The Philippines. New crop sales for 2025/26 were minimal at 11,200t. Exports totalled 428,700t, slightly lower than the previous week but above the four-week average, with Mexico, The Philippines, and South Korea as leading destinations.

Rising trade tensions under President Trump are adding uncertainty to the wheat market outlook. Announced plans for a 25 percent tariff on imported vehicles, along with threats of broader tariffs on the EU and Canada, contribute to a risk-off tone across commodities. These measures, along with unresolved shipping tax policies, may disrupt global trade flows and logistics, indirectly weighing on US wheat exports. Potential for negotiation with China over social media platform TikTok and ongoing tariff flexibility hint at broader trade recalibration, further complicating the global demand environment for US agricultural products.

Corn and soybean markets are moving in opposite directions as bearish sentiment continues to pressure corn, while soybeans find support from biofuel optimism and acreage positioning. Corn futures made new lows with expectations for a massive US planting area and large ending stocks dominating sentiment, despite the US holding the cheapest export values globally. Weekly corn sales were solid at 1.04 million tonnes but slightly below expectations. In contrast, soybeans rallied, driven by strength in bean oil following reports that the Trump administration is pushing for higher biofuel blending mandates. This policy shift, alongside beans being used as the long leg in corn short strategies, is providing solid support even as export sales came in below expectations for beans and meal but strong for bean oil.

Australia

WA canola keeps improving, with conventional bids for the current crop at A$785 and GM at $735. The new crop was $830, with GM at $750 in Western Australia. Wheat was softer for the new crop, with bids down around $5 to $370, while the current crop remained around the same. Barley was solid, with a bid of $356.

In the east of the country, canola improved, with the current crop at $785 and GM at $690. The new crop was $760, with GM at $660. Wheat was $342, and barley remained firm at $322.

Delivered Darling Downs markets for wheat are currently bid at around $355 for the current crop and $370 for the new crop, with barley trading around $340 for the current crop.

Sorghum remains well bid, with delivered Brisbane/Newcastle bids around $380, supported by solid demand for sorghum and barley into China.

HAVE YOUR SAY