Weather: Somewhat disappointing weekend weather for Argentina. Some rain still is forecast but not enough given the recent heat. Russia much the same with very little moisture on the forecast. It is game time now with winterkill and production forecasts being cemented in the next month. Still lots of differing views around what the outlook for Russia is production-wise.

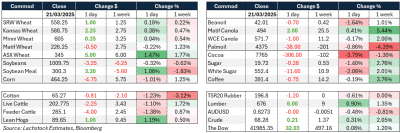

Markets: Pretty boring week if you are just focused on the last 5 sessions. Veg oil prices are all over the map with palmoil down and canola higher. AUD back under 0.6300.

Australian Day Ahead: Here we go again – excessive rainfall and flooding risk heading to Qld in the next 7 days. Meanwhile, Vic, SA and WA will only see light falls for the next 2 weeks. There is still plenty of time but forecasts will start to be traded. Feels like we trade firm to start the week.

Offshore

Bullish factors

Weather threats:

- Forecast rains removed for Southern Plains (HRW wheat area); potential dryness through April.

- Black Sea (BSEA) remains dry with only slight rain potential in week two.

Global supply risk:

- Market contending with massive global short positions.

- Still time for weather to worsen in key areas like Russia and the US.

- Uncertainty in Turkey: No clarity on imports — could spike demand later if they open up.

- Ukrainian spring wheat planting is up, but this also signals potential shifts in demand if domestic usage rises.

Bearish factors

- Lack of follow-through: Gains early in the week faded; choppy trade. Russian wheat remains competitive at US$256 FOB — dominant in global trade.

- No major demand catalyst — Turkish demand not expected to spike.

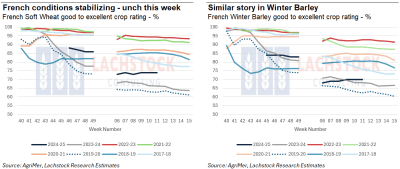

- French wheat conditions holding at 74 percent, which is better than last year.

- MATIF wheat prices down modestly.

- In a recent report, the MLA has indicated that A$4.5b of beef and $1.5b of lamb exports to the US would be at risk if Donald Trump imposes an import tariff.

French 2025 (black line on the left chart) crop conditions for soft wheat are rated 74 percent good-to-excellent, slightly ahead of winter barley shown on the chart on the right. Source: AgriMer via Lachstock.

Australia

WA canola was stronger to end the week with new crop bids in WA $820 for conventional and $750 for GM. Wheat was unchanged $382 and barley $338. Current crop barley firm at $360.

Through the east of the country current crop canola bids continue to make back recent losses bid $775 for conventional, wheat $345 and barley bid $320.

The Griffith/Hanwood market zone continues to do a good job at stopping the flow of wheat from SNSW into Vic and SA, with Jun delivery bid $350.

Lentil bids are currently around $850-$860 delivered Melbourne with decent demand still there.

HAVE YOUR SAY