Weather: More of the same globally for weather – BlackSea and nothern EU remain dry, but most productions continue to increase. Swings and roundabouts in the US – significant rainfall forecast throughout the HRW belt but then some signs of a dry May. Australian rainfall still missing SA, light showers throughout WA but NSW and Vic look encouraging.

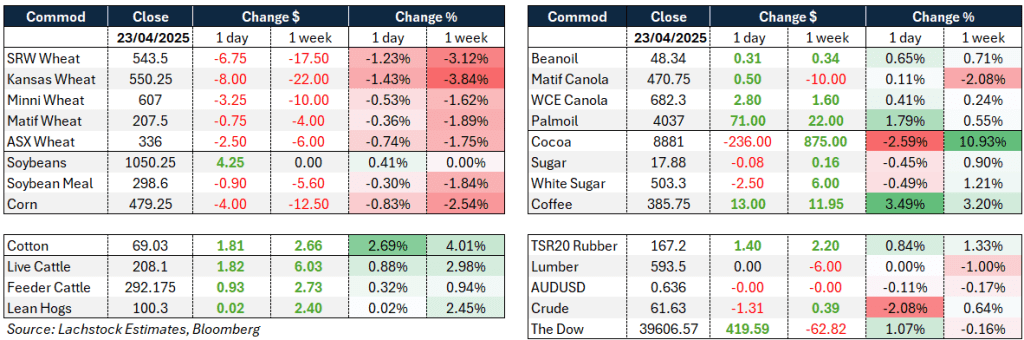

Markets: Asset reallocation. Lower USD generally means higher commods – not this week – felt very much like broad brushed risk off amid Trump fueled market volatility. What next? Simply, a China/US agreement would be supportive to the USD as the market removes some inflation risk but we have no idea what that looks like. If you want an indication of how strange things are, 21 correlations are fascinating – Coffee and Live Cattle are 90pc correlated, Corn and WCE Canola are 91pc linked.

Australian Day Ahead: Every overnight wire talks about how thin volumes are at the moment – Australia has the added kicker of the ANZAC day vacuum. Vic old crop markets will be interesting if and when this rain comes – the push pull of growers removing themselves from the market as they get busy sowing vs the sentiment shift a good drink can bring. Barley continues to find its way on a boat on both sides of the country which is underpinning values. Planting weather/AUD/Donald – yep… easy. ANZAC day – Lest We Forget.

Offshore

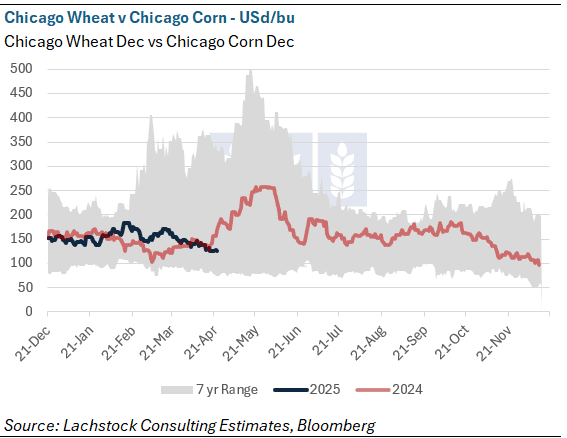

Wheat – US wheat futures continued to trend lower, with July delivery falling 1.1pc to $5.45/bu.

The market is weighed down by favorable planting weather and a lack of fresh demand, even as conditions in China and the Black Sea show signs of drought stress.

Market chatter points to potential upside if adverse weather drives crop losses, given that fund traders remain net short. Some support could emerge from renewed Chinese or SRW interest, though there’s currently little follow-through.

Systematic buying was seen in wheat, but not in large volumes.

Meanwhile, CBOT wheat shipping stations along the Ohio River resumed operations after flooding receded, and South Korea tendered for 50,000t of US milling wheat.

Egypt forecasts slightly reduced wheat imports next fiscal year, supported by strong domestic buying and adequate stockpiles.

While EU crops are faring well, Black Sea dryness is concerning, possibly shifting global wheat availability dynamics again for 2025–26.

Other Grains and Oilseeds – Corn futures softened with July falling 0.8pc to $4.79 3/4 as favorable Midwest weather continues to support rapid planting progress.

Market sentiment is weakening, with trend-following funds reducing long positions as momentum signals deteriorate.

Ethanol production rose more than expected to 1.033m bpd while stocks dropped to 25.48m barrels, lending some support, though not enough to lift prices.

Safrinha corn crop prospects in Brazil are improving and US corn remains the cheapest globally.

Meanwhile, soybeans managed a modest gain, with July futures rising 0.5pc to $10.50 1/2. Old crop beans saw relative strength on ideas of possible export increases and short-covering amid trade optimism.

India’s return to palm oil buying, with imports projected above 700,000t monthly from July, could influence oilseed dynamics.

Ukraine’s rapeseed harvest is expected to decline, prompting a forecast rise in export prices to $540–$560 delivered to crush plant.

Macro – Markets reacted positively to reports that the US may consider lowering tariffs on China to 50–65pc, though Treasury Secretary Bessent later walked back those claims, saying no firm offer was on the table.

President Trump affirmed he has no intention to fire Fed Chair Jerome Powell and projected a more conciliatory stance toward China in future trade talks.

Equity markets rallied, with the S&P 500 up 1.7pc and the Dow 0.9pc, while European indices also posted strong gains.

US 10-year yields fell to 4.39pc, and oil dropped 2.4pc to $62.10/bbl amid broad risk-on sentiment. Gold declined 1pc to $3,295.50/oz.

Elsewhere, the White House is preparing to sign non-binding trade frameworks with Japan and India, and US-UK trade negotiations are set to push for reduced tariffs and agricultural market access.

The broader tone in ag markets remains lethargic, likened to “December markets” — thin volumes, mixed flows, and traders awaiting clearer directional signals.

Australia – Bids were firmer for GM canola in the west yesterday on the back of a continued rally in Canadian futures, with new crop bids at $760 and old crop $720. Representing a spread of $85 on new crop. Wheat bids were $377 and barley $337 for new crop.

In the east, bids were softer on Wednesday with canola down around $15 on new crop, bid at $792 and $692 for GM. Wheat was $362 for new and $344 for current crop, with barley at $335.

New crop delivered canola bids are around $820 delivered Geelong/Melbourne, with current crop delivered GM bids at $740, with strong demand from container packers for GM at the moment.

Sorghum bids were a little softer in the last week, with Darling Downs bid around $364, down from $370, and Brisbane at $388.

Expecting canola hectares to be back through SNSW, NW VIC and SA, with dry conditions and a closing planting window indications of around a 20% reduction in area through these regions, with growers opting for lower input cost cereals.

HAVE YOUR SAY