Weather: Showers over the weekend benefited much of the Central and Southern Plains, though the southwest remained dry. More favorable rainfall is expected this week. Flooding continues to hamper SRW wheat in the Delta and Midwest, with additional rain likely to prolong issues. The eastern Black Sea region received some rain, but overall soil moisture remains low, with limited rainfall ahead. Europe is seeing favorable rainfall, though dry northeastern areas are still missing out. Northern Africa saw helpful showers for wheat fill, but drought conditions persist, particularly in Morocco.

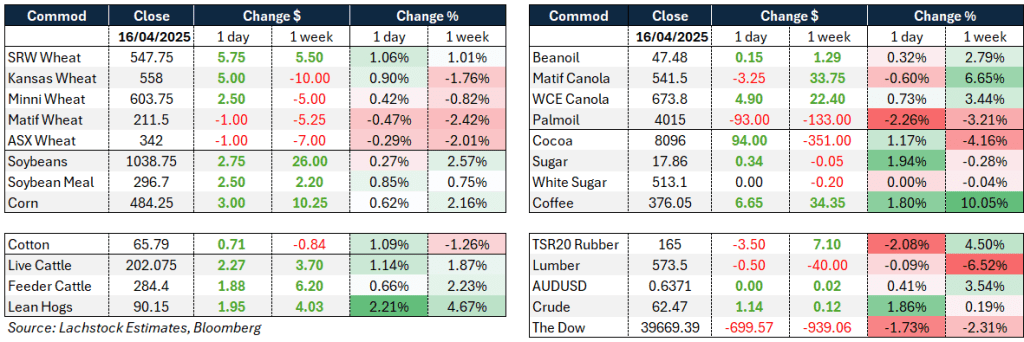

Markets: Someone else’s fault. Donald’s message is clear – if the Fed doesn’t drop rates, it’s their fault the US growth will slow. The sanctity of the US Federal Reserve looks to be tested but, in fairness, he did the same thing last time he had the keys to the White House.

Australian Day Ahead: A week sandwiched between Easter and ANZAC day means plenty of Australia would have taken some leave and those that remain will lack incentive to push a view. Offshore markets remain in the grips of Donald and his Truth social account. AUD at 0.6400 seems about right today given the push-pull between US rates and China growth – expect the Aussie market to remain quiet this week.

Offshore

Wheat – Wheat futures declined with WN down 10c, KWN off 6.25c, and MWN losing 5.25c, as the market opened firmer but quickly reversed amid fading optimism over vessel taxes and a weaker dollar.

Despite stronger-than-expected U.S. inspections (510.3k, 14.4% above last year), the market struggled with persistent bearish sentiment. Contributing to the weakness were improving weather forecasts for U.S. HRW regions and Russia, news that Turkey’s crops avoided frost damage, and Iraq’s plans to remain self-sufficient in wheat for a third consecutive year.

Russian crop health has also improved, with 90% of winter crops now rated good or satisfactory.

French wheat remains under pressure from heavy speculative shorts, while U.S. wheat remains historically cheap, but lacks demand catalysts.

U.S. winter wheat condition fell 2% to 45% good/excellent versus expectations for no change.

Iraq expects to procure 4.5 million tons of wheat locally this season and has 2.8 million tons in reserve, enough to cover its subsidy program for more than a year and a half. The country has not imported wheat for subsidy purposes for two years and may hold off until 2026. Procurement prices remain high to support domestic growers, with strategic reserves preferred over exports, despite offers from countries like Tunisia.

The revised USTR measures have been softened, significantly reducing their impact on the dry bulk shipping market overall. However, they remain highly punitive for vessels that are built, owned, or operated by Chinese entities. Under Annex 1, fees are calculated based on Net Registered Tonnage (NRT) and will take effect in October 2025, gradually increasing through to April 2028. Initially, lump-sum fees per port call will be around $630,000 for Handy-size vessels and $1.3 million for large Panamaxes, eventually rising to $1.8 million and $3.8 million respectively by 2028.

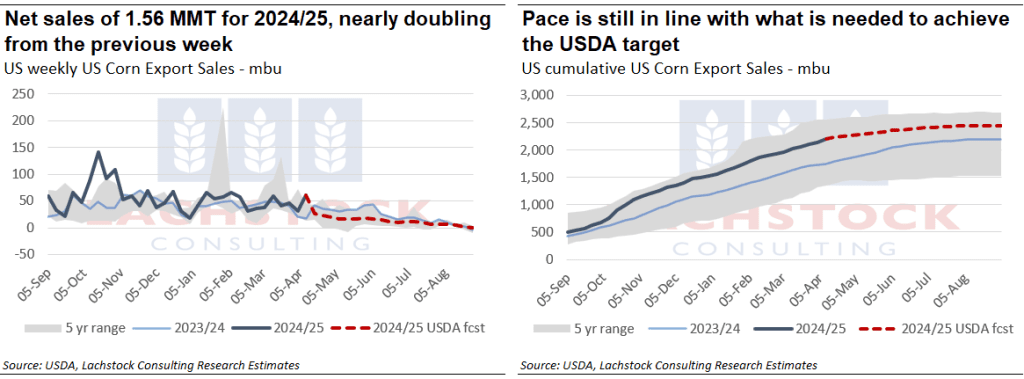

U.S. corn planting reached 12%—in line with expectations—but wet forecasts may delay progress.

China remains absent as a major buyer, while Brazil and Argentina see episodic showers and continued harvest progress.

Soybeans traded lower, with SN down 6.25c and SX off 6.75c. July crush margins were flat at 150.5. Bean inspections came in at 551k, keeping the annual pace up 10.9%. The market continues to wait on trade clarity, especially for new crop sales to China. For now, old crop remains well supported.

Chinese soybean imports from the U.S. surged 62% in Q1, while Brazil’s share dropped sharply. However, Brazil is expected to dominate again in the coming months as harvest progresses. Chinese soybean stocks are at their lowest in nearly three years due to tight imports, but this is expected to ease soon.

China forecasts a record 709 MMT grain crop this year, with soybeans leading in percentage growth at +2.5%.

Macro – Global risk sentiment wavered after President Trump renewed attacks on Fed Chair Jerome Powell, calling for immediate rate cuts. Trump claimed the U.S. faced no inflation threat but warned of a looming slowdown without Fed action. The S&P 500 dropped over 3% on concerns Powell could be fired, though legal protections limit such action. Trump’s pressure comes as the ECB has begun to cut rates and the IMF/World Bank spring meetings get underway.

Meanwhile, U.S. inflation cooled slightly in March, but Fed officials remain cautious, wary that tariffs could reignite price pressures.

Trade tensions between the U.S. and China continue to escalate. The Trump administration imposed new port fees on Chinese-built and operated ships, prompting strong protests from Beijing. China has signaled it will respond with countermeasures, and is increasingly turning to non-tariff actions like targeting U.S. firms and shifting domestic focus for key exporters like Alibaba and JD.com.

China is also keeping tight export controls on strategic metals vital to tech and defense.

Japan may increase soybean and rice imports as part of negotiations with the U.S., amid broader disputes over auto and agricultural trade access.

Meanwhile, Brazil and Argentina continue to benefit from shifting global trade flows, especially in grains and meat, as Chinese demand reorients away from U.S. suppliers.

Australia – Canola bids ended a short week bid $860 for new crop in WA on Thursday, with new crop wheat $380 and barley $340.

Through the east of the country, canola was improved on Thursday with new crop bids $812 and GM $717. Current crop wheat was $350 and barley $336.

Some welcome rainfall for SA’s Southeast, with 20mm through large parts giving growers some confidence. An ANZAC Day ‘break’ looks on the cards for most of VIC and NSW, with 25–50mm forecast throughout most parts of these states.

Expect a quiet week in the markets as growers and consumers look ahead to next week, with a widespread rainfall event likely to bring some liquidity to the old crop markets.

Australian barley export pace remains solid with 68% of LSC’s 7.66mmt of exports for 24/25 having already been done (Oct–Apr). WA sits at 69%, SA 58%, Vic making strong progress at 79% completed, and NSW still having some work to do at 50% done.

Old crop Barley imports from China continue at a strong pace and dominated by Australian Origin. We are starting to see lineups from Argentina lift to China.

HAVE YOUR SAY