Weather: All kinds of weather is being thrown at the US Plains – some areas set to get 10 inches in the next 15 days, a bunch of snow and all kinds of wind. To this point in the calendar the US would normally expect around 219 tornados, they are running at 304. The tornado “season” is April to June. Russia is getting drip-fed with rain. Why is nobody talking about Germany. It looks way behind to me, but no one seems to be concerned.

Markets: Ags will undoubtedly be affected by Donald Trump’s Rose Garden address tonight, just how remains to be seen. Vegoil rallied hard on ideas that the biofuel mandate uncertainty is set to end with the EPA proposal.

Australian Day Ahead: Trade will probably be a little defensive ahead of tonight’s address – vegoil looks bid – grains may find support from lower US acres and green shoots of global demand.

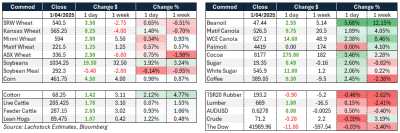

Offshore

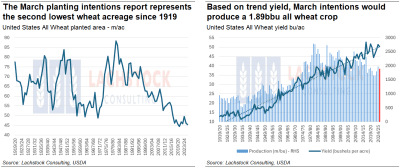

US planted wheat area intentions (left) and trend-yield-based crop outlook (right), the vertical red column indicating a US wheat crop of 1.89 billion bushels. Source: USDA via Lachstock. Click expand.

Wheat futures climbed across US exchanges and Matif, driven by short covering and a global re-evaluation of supply risks. France secured fresh demand, Russia is momentarily out of the market, and US wheat remains competitive. Tighter acreage for SRW and HRS, mixed with favourable weather prospects and easing corn pressure was largely a push across the wheat complex.

Grain markets brace for possible chaos around “Liberation Day,” with US markets set to close ahead of Trump’s tariff announcement. Meanwhile, weather remains a key factor for HRW wheat areas, and demand signals are emerging — notably from Morocco for French wheat. In soybeans and corn, tight old crop supplies and biofuel optimism are driving attention, though policy and trade uncertainty loom large. The US Environmental Protection Agency plans to release a proposal on biofuel blending mandates that covers two years worth of mandates, instead of a proposal that covers three years, Reuters reports.

Argus Media reduced its 2025/26 Russian wheat production estimate to 80.3 million tonnes, citing lower expected spring wheat plantings. Despite improved winter wheat conditions, weak global prices and sluggish importer demand are discouraging new crop investment in the world’s top wheat exporter.

Canadian canola is under threat from looming US tariffs following existing Chinese restrictions, hitting its two biggest export markets simultaneously. Anti-seed oil sentiment in the US is also growing, led by public figures favouring animal fats like tallow. While farmers may shift acreage, some remain committed to canola. Futures rose slightly on biofuel hopes and tariff delay speculation, but long-term demand challenges persist. Oddly, futures were well bid overnight, as was the whole veg oil complex.

StoneX trimmed Brazil’s 2024/25 soy and corn output forecasts due to weather issues, particularly in southern regions. Soy output is still expected to hit a record, though ending stocks are revised lower. Corn estimates were also cut slightly, especially for the first crop. While exports remain steady, reduced yields in key areas are tightening the overall balance.

President Trump is set to announce sweeping tariffs that will take effect immediately, with a focus on implementing “reciprocal” duties to rebalance US trade relationships. While the specific scope remains unclear, the move aims to boost US manufacturing and challenge global trade norms. Trump signalled flexibility for allies, but markets are bracing for volatility amid uncertainty over foreign retaliation and potential economic fallout.

The Kremlin confirmed that communication with the US continues, even as President Trump threatens secondary sanctions on Russian oil. Kremlin spokesman Dmitry Peskov described the situation in Ukraine as highly complex, emphasizing that diplomatic channels remain open despite escalating economic pressure from Washington.

The Australian dollar is recovering slightly after recent declines, supported by a steady RBA and improving Chinese data. However, global risk sentiment is fragile ahead of US tariff announcements, weighing on commodity-linked currencies. Market scepticism toward AUD is evident in rising bearish positions, while focus shifts to potential Fed rate cuts in June.

Australia

Canola bids were slightly softer in WA yesterday with current crop conventional bid A$795 with new crop bid $840 and GM $745. Wheat was firmer +$5 with bids $371 a similar level for old and new crop, barley was bid $357.

In the east of the country canola was unchanged bid around $704 for current crop and $784 for new crop. Wheat was improved slightly bid $345, and barley was $324.

Reuters reported 5 trader/analysis estimates have the 25/26 Australian wheat crop pegged at 28.6Mt down 16pc on last year. Highlighting persistent dryness through Vic and SA as the major concern heading into this year’s plant.

Delivered malt bids into Melbourne/Geelong are currently around $372 for PL1 and $360 for MA1.

HAVE YOUR SAY