Weather: Globally, the Central and Southern Plains in the US continue to receive limited rainfall, only partially benefiting developing wheat, while heat in drier areas adds stress. SRW wheat in the Delta and Midwest faces ongoing flooding, with more rain expected in a persistently active pattern. The eastern Black Sea region saw some recent showers, but moisture levels remain below normal. Europe is receiving multiple systems bringing beneficial rain. Northern Africa has seen improved conditions for wheat, though drought remains, especially in Morocco.

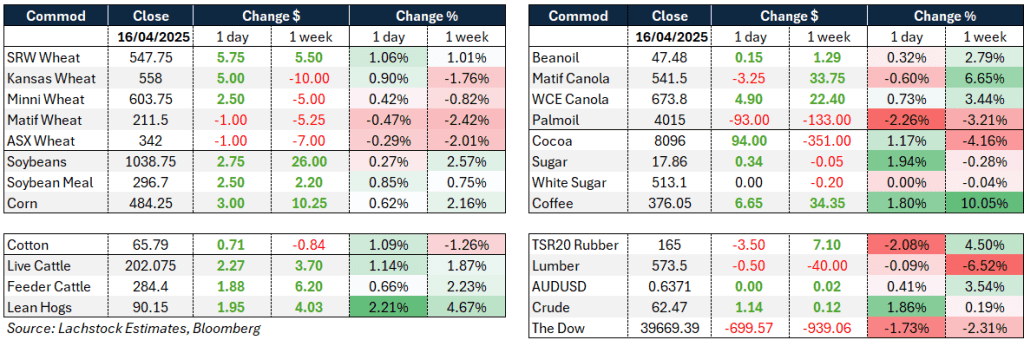

Markets: While slightly higher, the markets have a sense of trepidation about them, awaiting the next tariff blow up. The push and pull between ag markets trading fundamentals vs outside market noise is hard to predict but it feels like we need a few break throughs in negotiations so we can focus on growing conditions.

Australian Day Ahead: Mixed bag again – AUD not providing direction today which allows the trade to focus on export margins and weather forecast. Fingers crossed parts of SA and Vic get some rain this weekend.

Offshore

Wheat – Wheat futures gained midweek, supported by a weaker US dollar and weather concerns. Chicago rallied up to 1.5pc, aided by forecasts for additional heavy rainfall across already saturated SRW regions in the southern Midwest and Delta.

The CME declared force majeure on Ohio River deliveries due to flooding. In contrast, dry southern Plains areas, including parts of Texas, remain wildfire-prone, though widespread rain over the next two weeks is expected to benefit HRW crops.

Trade remains attentive to weekly U.S. export sales, with expectations around 200k tons.

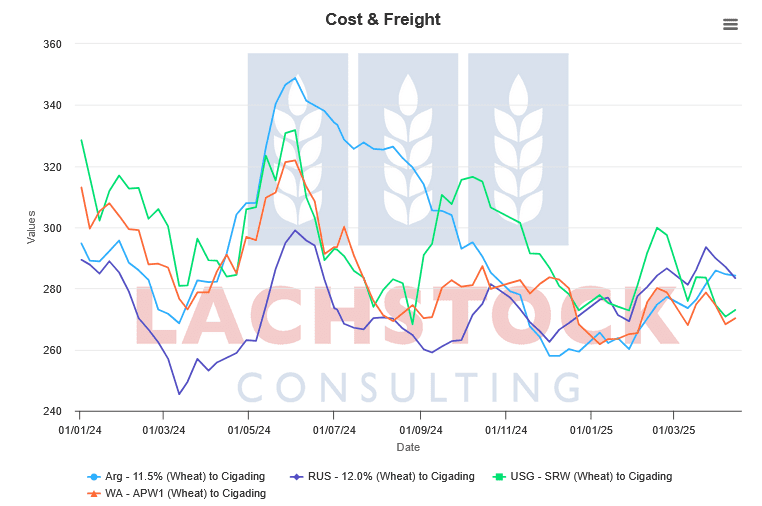

Globally, Algeria booked close to 600k tons of wheat, mostly from Romania and Ukraine, while Tunisia and Jordan tendered for more.

India’s wheat stocks surged to a three-year high, and Russian output was trimmed slightly following hail and frost damage.

EU exports lag sharply year-on-year, though France marginally lifted its seasonal estimate.

Other grains, oilseeds – Corn inched higher, lifted by planting delay concerns, competitiveness in global markets, and a softer USD.

US ethanol production topped forecasts at 1.012 million b/d, with inventories down slightly. Iran issued tenders for 120k tons each of corn and barley, while EU corn imports rose 14pc year-on-year.

Soybeans edged higher, helped by trade optimism, firmness in meal and oil markets, and positioning ahead of a holiday weekend.

Argentina’s harvest lags well behind average, and Iran tendered for 120k tons of soymeal. Brazilian bean premiums eased on reduced China buying, but US crush margins improved.

Bean export sales are forecast at 450k tons, with meal and oil at 270k and 20k, respectively.

Tariff-related shifts in the US biofuels sector may boost soy oil demand amid lower UCO imports.

Macro – Global markets softened as Fed Chair Powell flagged a likely divergence from inflation and labor goals for the rest of 2025.

Tech shares led US equities lower, with the Nasdaq falling 3.1pc after news that export controls could cost Nvidia $5.5 billion. The S&P dropped 2.2pc.

Bonds rallied, with 10-year yields falling to 4.28pc.

Oil rose 3.5pc to $62.60/bbl, and gold hit a record $3,339/oz.

US retail sales rose 1.4pc m/m in March, led by autos as consumers frontloaded purchases ahead of new tariffs.

Core control group sales increased a more modest 0.4pc.

Trade tensions continue to mount, with Washington imposing tariffs up to 245pc on certain Chinese goods.

China demands respect and a single point of contact before negotiations can proceed.

Japan begins talks with the U.S. this week, drawing close attention as markets look for potential concessions.

Australia – Canola firmer again yesterday by $5 through the west, with current crop $810 and new crop $850 with GM $715 and $755. Cereals unchanged with new crop wheat $377 and barley $338.

In the east of the country, new crop canola bids were improved to be around $804 with GM $710. New crop wheat was $375 and barley $325.

Pulse bids remain supported with delivered Geelong/Melbourne lentil bids around $860 and Fabas $650. Less clarity on the new crop front but Fabas indicated to be around $540.

Chickpeas delivered Brisbane are $930 for current crop and $825 for new crop.

Delivered Darling Downs markets are $355 for current crop wheat and $370 for new crop, with barley $336 current and $345 for new crop.

In the west, wheat bids have been volatile with currency fluctuations, giving up most of the $15 gain seen early last week — not surprising given export dominance in the west. The east has seen more stable gains, driven by tighter supply, especially in VIC and SA.

HAVE YOUR SAY