Weather: Wheat conditions globally are mixed. In the US, limited showers in the Central and Southern Plains have offered only partial relief, while frost and ongoing dryness remain concerns. Flooding in the Delta and Midwest is disrupting Soft Red Winter wheat. In the Black Sea, recent showers have helped but soil moisture remains low; upcoming cold isn’t expected to cause major damage. Eastern Europe has seen some improvement, though dry conditions persist in the northwest. Northern Africa received helpful rain, but drought continues, particularly in Morocco. China’s winter wheat is progressing well overall, though more rainfall would be beneficial.

Markets: Early in the day President Trump posted on his Truth Social page “THIS IS A GREAT TIME TO BUY!!! DJT & BE COOL! Everything is going to work out well. The USA will be bigger and better than ever before!” A few hours later President Trump authorised a 90-day pause on tariffs and raised the tariff rate for China to 125 percent, effective immediately.

Australian Day Ahead: Since the beginning of the month, Kwinana APW wheat is up A$20/t. Dec-25 in Aussie terms is up $20 over the same period. Last night’s currency move was worth -AUD$11/t and, given that the US has given a tariff reprieve, does that mean Aussie wheat has to compete harder? We have been the cheapest origin throughout this whole debacle but the Asian consumer isn’t panicking.

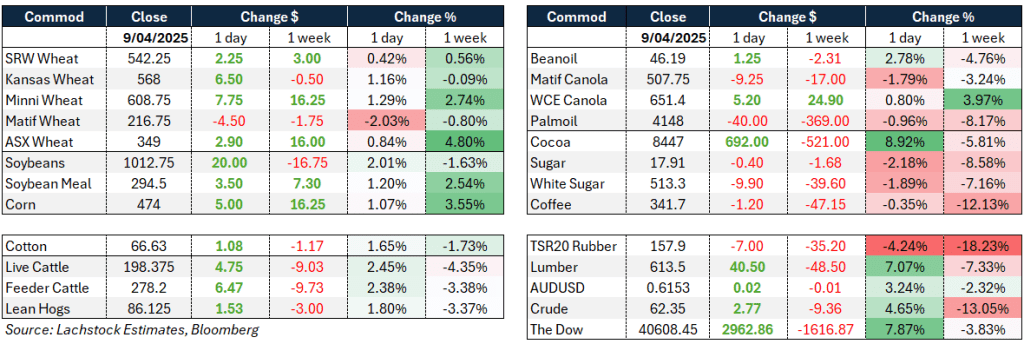

Offshore

Wheat – US wheat futures saw moderate gains, with Soft Red Winter, Hard Red Winter, and spring wheat all firming, despite pressure from European markets where MATIF lost ground due to benign weather in the EU and Black Sea, and a general lack of demand. World wheat trade for January through June is on track to fall by 10-15 million tonnes (Mt) year over year, with China’s absence from the market being strongly felt; China imported 9.3Mt over that same period in 2024.

Export demand continues to tick along. Egypt is planning to hedge against wheat and fuel price volatility in the upcoming fiscal year to deal with the broader economic turbulence caused by US tariffs. Jordan has issued a tender for up to 120,000t of milling wheat, while Algeria has reportedly purchased somewhere between 200,000 and 450,000t of durum, likely sourced from Canada, the US, or Australia.

Argentina’s Córdoba province is expected to see record wheat planting in the upcoming season, reaching 1.75 million hectares, helped by favorable soil moisture. On the other hand, Russia’s Stavropol region —one of its top wheat-producing areas — suffered a severe hailstorm that has caused crop damage, adding more uncertainty to Black Sea supply expectations. Meanwhile in the US, growing conditions remain mixed, with SRW areas facing excess moisture and HRW regions turning dry again.

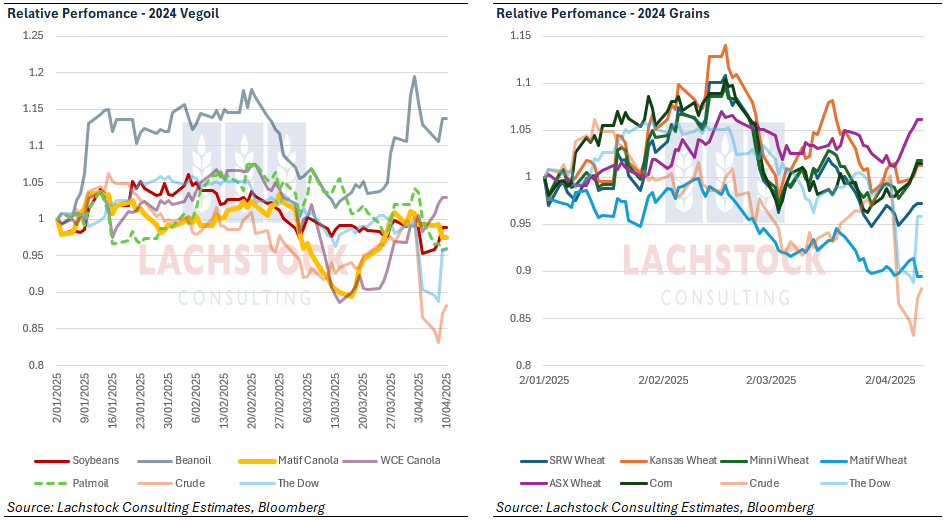

Other grains, oilseeds – Corn markets were firm, with both nearby and new-crop contracts showing gains. A combination of improving sentiment in crude oil, continued optimism around demand, and pre-WASDE positioning contributed to the strength. Ethanol data showed lighter-than-expected production. Exports remain key to corn’s tone, with 1Mt expected in the upcoming report.

The oilseed complex saw a sharp late-session rally. Soybean contracts gained ground alongside soymeal and soyoil, with lingering uncertainty around China’s future participation in US markets. For now, China is expected to take about 3Mt of US soybeans in April and May, largely government purchases via Sinograin that will likely go to state reserves. These cargoes are expected to ship, but the higher tariff burden means they’ll need to be sold at a discount locally to compete with cheaper Brazilian supply. While current-crop sales are finding homes, new-crop trade remains fluid and sentiment continues to shift quickly, ranging from total collapse of Chinese buying to possible breakthroughs in trade negotiations.

Elsewhere, EU soybean imports are up 5pc year on year, totaling 10.33Mts as of early April. Malaysian palm oil futures closed lower under pressure from Dalian and Chicago markets, along with global anxiety surrounding trade friction. In Mexico, drought and water shortages are expected to cause the country’s biggest grain production drop in 25 years. Sonora is among the worst-affected regions, and the escalating water issue could become another friction point between Mexico and the US, on top of existing tensions around security, migration, and tariffs.

Macro – The broader macro landscape remains dominated by escalating trade tensions, market volatility, and reactive policy shifts. President Trump announced a 90-day pause on certain tariffs shortly after they took effect, but this did not apply to China. The announcement caused sharp reversals across equity and commodity markets, with equity indexes rallying 8-12pc and commodities broadly following suit.

Despite the temporary pause, there is no clarity on which countries are actually exempt. The original messaging suggested only non-retaliatory nations would be spared. The Trump administration is also reportedly considering tariff exceptions for certain US companies, especially those tied to agriculture and shipping. US wheat held up relatively well in this environment, though European contracts came under pressure.

In Egypt, the government is taking steps to manage the fallout from trade disruptions. Prime Minister Madbouly confirmed the country is hedging core commodity inputs including wheat, fuel, and edible oils. Egypt has seen foreign capital outflows and currency depreciation, prompting further economic reforms tied to its IMF agreement.

China’s yuan has fallen to its weakest level since 2007, as markets respond to increased tariffs and capital pressures. While the People’s Bank of China is attempting to prevent a sharp slide, the general expectation is for further monetary easing.

On the trade side, Beijing continues to prioritise food security, with Sinograin absorbing the costs of soybean imports even under higher tariffs.

Bangladesh has offered to ramp up imports of US wheat, corn, soybeans, and cotton in hopes of securing a three-month grace period on newly imposed US tariffs. They also committed to reducing other trade barriers and facilitating customs processes for key US goods.

Australia – Another good day for canola in Western Australia, with bids making it to A$836/t for current crop and $875/t for new crop, with GM at $763. Wheat was stronger, with current crop at $381 and new crop at $390; barley was bid at $381 with new crop bid at $393.

In eastern states, canola improved with current crop at $792 and new at $822, with GM at $722. Wheat improved to be bid at $350 with new crop at $375, and barley was $333.

No rainfall of note is forecast for the next 10 days for South Australia, Victoria, and New South Wales, with little to no soil moisture through large parts. Canola hectares is now beginning to be lost to cereals and lentils.

A heavy lamb indicator above $8 sees good margins for lamb feedlotters, with strong demand for barley in SA — bids are now around $360/t delivered to Murray Bridge, the South East, and Mid North. Lupins are becoming increasingly hard to find, with delivered SA prices around $700/t.

HAVE YOUR SAY