Weather: It is a mixed bag across the world. Key HRW growing areas prospects improved, but there is also a chunk of snow that could stretch onto the Plains. There is a massive hole in the prospects in the US, massive rain is forecast for the Delta, hot and windy in other areas. Russia is still lagging but it does not seem to matter because EU last week increased its production forecast.

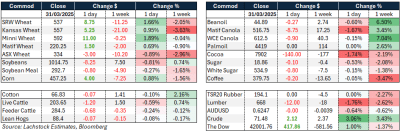

Markets: USDA report cutting wheat acres without conviction gave markets some bounce. Wheat is still lagging near contract lows so the next few week of weather and export sales matter the most. Yesterday was a rare down day in vegoil ahead of tariff-palooza.

Australian Day Ahead: No weather is on the forecast for the WA, SA and Vic basically are rainfree for the next 15 days. North is wet with some more on the way. Values in the north will continue to widen the bid / offer spread, south unchanged.

Offshore

The USDA report overnight had total 2025 US wheat planted area estimated 45.4 million acres, a 2 percent decline from 2024 and, if realised, the second lowest on record since 1919. Winter wheat accounts for 33.3 million acres—down 2pc from the previous estimate and slightly below last year’s level. This includes 23.6 million acres of Hard Red Winter, 6.09 million acres of Soft Red Winter, and 3.66 million acres of White Winter wheat. Other spring wheat plantings are projected at 10.0 million acres, down 6pc from 2024, with Hard Red Spring making up 9.40 million acres. Durum wheat is expected to cover 2.02 million acres, 2pc lower than last year.

Wheat futures rose on Monday after the USDA unexpectedly cut its spring wheat acreage forecast, lifting May wheat by 1.8pc to $5.37 1/2 a bushel. Corn also gained 0.9pc, while soybeans fell 0.9pc. The USDA’s Prospective Plantings report showed corn acreage slightly above expectations at 95.3 million acres, but wheat acreage fell 2pc to 45.4 million acres. Markets initially dipped but quickly rebounded, as much of the data had already been priced in. Attention is now turning to the April 2 announcement of reciprocal tariffs by President Trump, which could impact US agriculture if trade tensions escalate. Weather patterns are also influencing sentiment, with dry conditions in the Plains and better moisture in the eastern Corn Belt likely to support early planting. Meanwhile, traders are scaling back long positions in grains. On a broader level, debate continues over global moves into gold, with Capital Economics suggesting China remains heavily exposed to the US dollar, despite increasing its gold reserves.

President Donald Trump will announce a new reciprocal tariff plan on April 2, focused on “country-based” tariffs to counter what the administration calls unfair trade practices. While sector-specific duties are also planned, they won’t be the focus of this event. Press Secretary Karoline Leavitt said the move is intended to protect American workers and industries, with countries like the EU, Japan, India, and Canada likely affected. Trump confirmed the tariffs would apply to all countries, dismissing talk of a limited rollout. The plan is part of a broader effort to boost US manufacturing and fund domestic priorities, but uncertainty around the tariffs has raised concerns over supply chain disruptions and inflation, contributing to ongoing market volatility.

President Xi Jinping’s efforts to present China as a pro-business, stable environment are being challenged by a dispute over billionaire Li Ka-shing’s proposed $22.8 billion sale of 43 global ports, including two in the Panama Canal. China’s market regulator is reviewing the deal, citing public interest concerns, just after Xi pledged to support foreign investors. The move has drawn criticism from Chinese officials, who accuse Li’s company of aligning with US interests, especially after President Trump framed the sale as reclaiming influence over the canal. The situation risks undermining investor confidence and highlights how China’s political influence over private deals can complicate its global trade relations and economic reputation.

Australia

WA canola started the week bid around A$800 for the current crop, with the new crop bid at $845. Wheat was lower at $370, and barley at $355.

Through the eastern states, canola bids were mixed to start the week, with the current crop at $785 and the new crop at $780. Wheat was $342, with barley at $324.

The Hanwood/Griffith market zone has taken a breather in the last week, with June wheat bids down from around $350 to $340, seemingly having encouraged enough grower selling. The Victorian delivered wheat markets have remained firm, given the Hanwood market had been absorbing a large volume of the SNSW wheat that needs to flow into Vic. Expect this flow to begin to change.

Barley demand through Victoria and SA remains solid as grower selling stalls, with farmers holding back surplus barley as a drought hedge and solid export pace so far for Vic. Delivered Geelong/Melbourne bids are around $353.

HAVE YOUR SAY