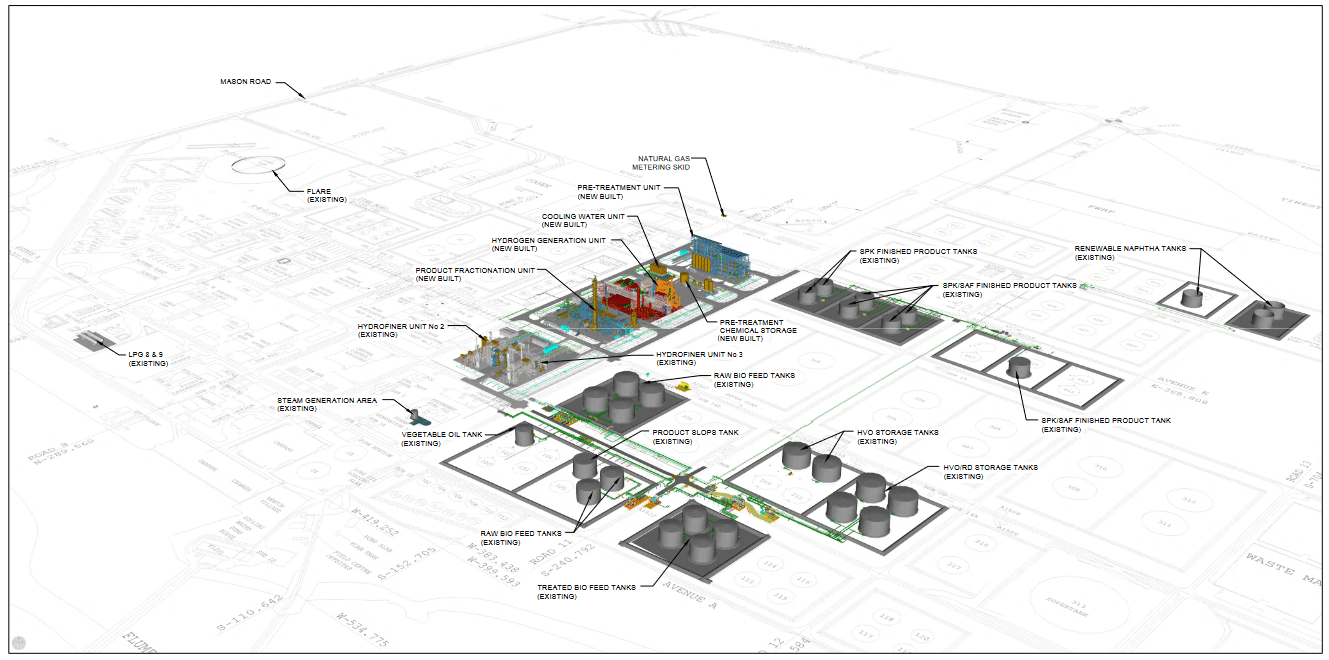

BP Kwinana has become an import facility since refining stopped in 2021, and its planned biorefinery will cover 10ha at the centre of the 250ha site. Photo: BP

THE WESTERN Australian Government has approved BP’s planning application to build a biorefinery on the company’s 250ha site at Kwinana.

Granted by the WA Department of Planning, Lands and Heritage on Thursday, the approval opens the door for a $580-million development on the site which has been in BP hands since 1955.

Before becoming an import facility in 2021, the site operated as an oil refinery, and was the biggest supplier by far of fuel to WA’s market.

Using feedstock which may include canola, of which WA is one of the world’s biggest exporters, the biorefinery is expected to form part of BP’s Kwinana Energy Hub, and produce sustainable aviation fuel (SAF) and synthetic paraffinic kerosene (SPK).

BP’s proposed biorefinery is expected to start operating in 2027 on a 10ha portion of the 250ha site, and repurpose some existing infrastructure, including hydrofining units, and storage tanks.

Proposed new infrastructure includes a hydrofiner feed pre-treatment unit, a hydrogen generation unit, a product fractionation unit, a by-product recovery unit, and a truck-unloading facility.

The plan for BP’s biorefinery. Image: WA Government planning online

Speaking at Bioenergy Australia’s WA Low Carbon Fuels Summit on October 11, BP low-carbon policy manager for Australian and New Zealand Pauline Kennedy said the plant planned to use domestic and imported feedstocks, with canola oil a likely domestic one.

“A lot of the Western Australia canola leaves from just down the road from us,” Ms Kennedy said, referencing CBH Group’s Kwinana terminal, a major exporter of canola, primarily to Europe where it is used as a feedstock for biodiesel.

“Cargill has been talking…about their plans for a crusher, so that would be really beneficial for a project like Kwinana, but we will also have the ability to import and have flexibility with the kind of feedstocks that we would use.”

Cargill Australia has entered into a land lease option with the WA Government for a parcel of land in the Rockingham Industrial Area adjacent to CBH’s Kwinana terminal.

Earlier this year, Cargill announced it was investigating the potential to develop a world-class canola crush plant on the site.

BP has indicated its plant will not be relying just on canola.

“We’ve designed the plant to be flexible and respond to what the market needs and what the market is telling us is the best thing to produce.”

Ms Kennedy said guarantee of origin for feedstock, demand for fuel produced, and a production subsidy were two of the key requirements for the biorefinery.

“We think that we do have all the ingredients…to have a really successful renewable fuels or low-carbon liquid fuels industry here.

“What is missing that we see in other markets where BP is active is we don’t really have the policy settings.”

BP’s submission dated July 23 to the A Future Made in Australia: Unlocking Australia’s low-carbon liquid fuel opportunity consultation paper calls on the Federal Government to subsidise LCLF.

“With the right policy settings, Australia can be an advantaged producer of LCLFs.

“It has access to the sustainable feedstocks needed to produce LCLFs at scale.

“It also has potential for material demand for LCLFs over the medium to long-term from hard-to-abate fuel users like aviation, mining, long-distance freight.”

The submissions says Australian LCLF producers will compete for capital, feedstocks and demand with production in other countries, and calls for a production incentive via a tax credit from 2027 to 2040.

“To secure investments in a domestic industry and unlock Australia’s potential, both a production incentive as well as a regulated demand mechanism are needed.

“We recommend the production tax credit is provided to the eligible litres produced of neat renewable diesel or SPK for SAF, with SPK receiving a slightly higher rate reflecting relative costs of production.”

HAVE YOUR SAY