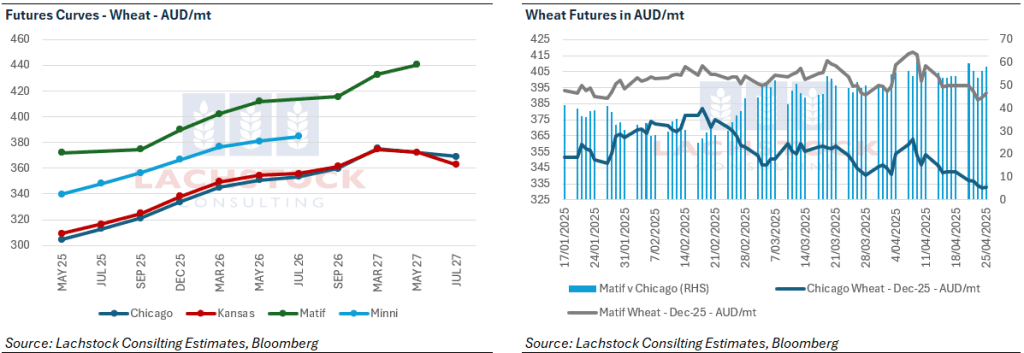

Weather: Concern around EU rainfall are starting to hit the wires, although it looks like France will get a drink over the next week. Germany not so lucky however with rainfall totals running around 200mm behind the 30 yr average for the growing season. Not much on the horizon for the Black Sea either.

Markets: Markets limped home last week – the anticipation over the raft of agreements the US is currently negotiating has sucked the life out of volume with cash sitting/waiting on the sidelines. The AUD technically failed to push through the 200 day moving average and now looks a little heavy – additionally, China seems the furthest from reaching a meaningful agreement with Donald which will add pressure.

Australian Day Ahead: Models are not really throwing up much moisture in the next week – probably keeps the old crop market bid while new crop interest from both sides of the ledger are less than inspiring. WA, as it seems to do, is leading the charge. AUD helps but we are toe to toe with competing origins now so it could be the domestic markets time to step in front of the exporters, especially with a light rainfall forecast.

Offshore

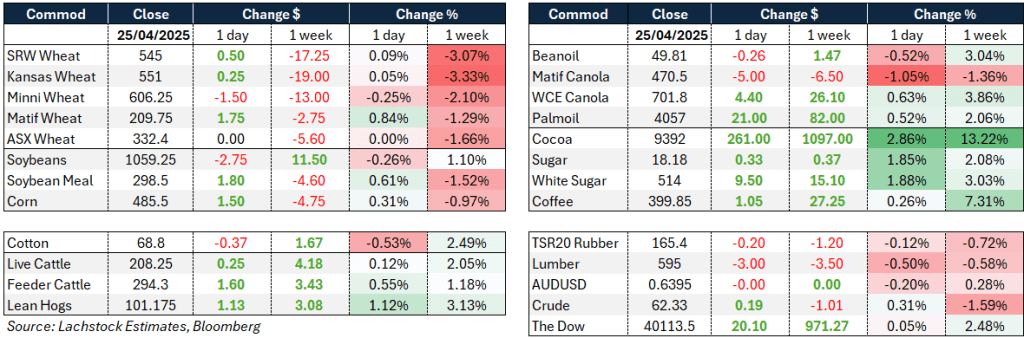

Wheat – US wheat futures were narrowly mixed into the weekend with WN and KWN fractionally higher while MWN slipped.

Paris Matif May wheat eased slightly but September firmed due to dryness in northern France, while Russian cash wheat was unchanged.

US wheat remains priced attractively for export opportunities, particularly if trade deals materialize with India and Southeast Asian nations.

Some analysts believe India could buy US wheat even without adjusting its 40pc tariff under a country-specific deal.

France’s wheat crop condition dropped to 74pc good/excellent, while Ukraine continues planting despite a 17pc slower pace year-on-year.

In Syria, the first shipments of Iraqi wheat aid arrived to address local food security needs following a severe drought.

Meanwhile, weather risks persist globally, with HRW crops largely made, but dryness remains a concern across China, parts of the EU, and the Black Sea Exporting Areas (BSEA).

Other Grains and Oilseeds – Corn futures traded in narrow ranges with CN finishing up and CZ slightly down.

Demand remains solid with a 235,000-ton sale to Mexico, and additional interest from Southeast Asian countries like Thailand and Japan, as they negotiate trade incentives with the US. Planting progress is expected to improve with relatively benign weather.

In South America, the Argentine corn harvest is 30% complete, and Brazilian safrinha corn production prospects have been raised.

Soybeans eased slightly with SN and SX both lower, while soymeal firmed and bean oil corrected after recent gains.

Nearby cash markets supported old-crop beans, but new-crop exports remain heavily reliant on reaching a China trade agreement.

Southeast Asian countries offered to increase purchases of US farm products, including soybeans and meat, as part of broader trade discussions.

Bean oil still awaits clarity on future mandates and tax incentives.

Macro – Trade negotiations dominated the broader market backdrop. President Trump’s administration received 18 written trade offers, with Asian countries like South Korea, Japan, and India leading efforts to secure interim deals to avoid steep tariff increases.

India appears furthest along, with negotiations covering 19 sectors including agriculture, e-commerce, and critical minerals.

Other Asian nations, such as Vietnam and Thailand, are also engaging actively, offering concessions like increased US farm imports.

European countries are moving more cautiously, with the EU skeptical about avoiding tariff hikes and the UK, Switzerland, and Canada adopting a patient approach.

Global market risks are tied to how these negotiations unfold, with Trump emphasizing building coalitions rather than isolating China.

Additionally, US crop market volatility is set to increase, with daily trading limits for corn and soybeans widened starting May 1.

Australia – In the west of the country, canola bids were steady to end a short week, with new crop bids at $850 and GM at $760. Wheat was softer, with current crop at $360 and new crop at $372, while barley was at $350 and $334 respectively.

Through the east, new crop canola was $792 and old crop $784. Wheat was $343 for current crop and $364 for new crop, while barley was $333.

Lentil bids are currently around $900 delivered to Geelong/Melbourne, with faba beans at $650.

There was some welcome rainfall through Victoria over the last week, with the Western Districts recording 15–25mm through most parts, and 10–15mm through the Wimmera.

Trade should return after a couple of disrupted weeks. Expect cereal bids to be back $1–2 based on futures and currency moves. Domestic demand is expected to remain strong, with feed demand still firm across most of Victoria and South Australia.

HAVE YOUR SAY