Weather: Yield estimates heading up in the EU tell you all you need to know – regardless of some of the more extreme moisture deficits, both the EU and the Black Sea have a sense of optimism. Aussie forecasts gaining some confidence for Vic rainfall but SA is still a wasteland. OK and MO got 2-5 inches which is too wet but Kansas has 1-4 inches which is much needed.

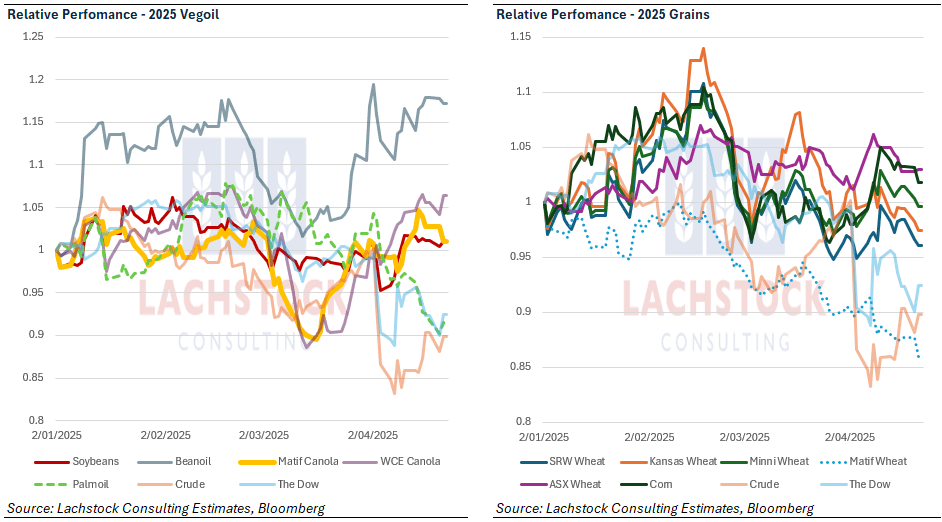

Markets: Donald still holds the strings to the market. The market seemed comfortable that he back tracked on his “Mr Too Slow” or whatever he was calling Powell who remains safe…for now. USD found a bid but commods really couldn’t find a reason to recover. Keep an eye on Iran – they are going to have a short wheat crop and Trump announced sanctions against Seyed Asadoollah Emamjomeh – this could be his next well publicised fight.

Australian Day Ahead: AUD down which will help our export competitiveness, which has been on the slide. SRW is super cheap right now and Aussie is now in the thick of the competition post having the market to itself. Once again, quiet week with plenty of the trade “working from mobile”.

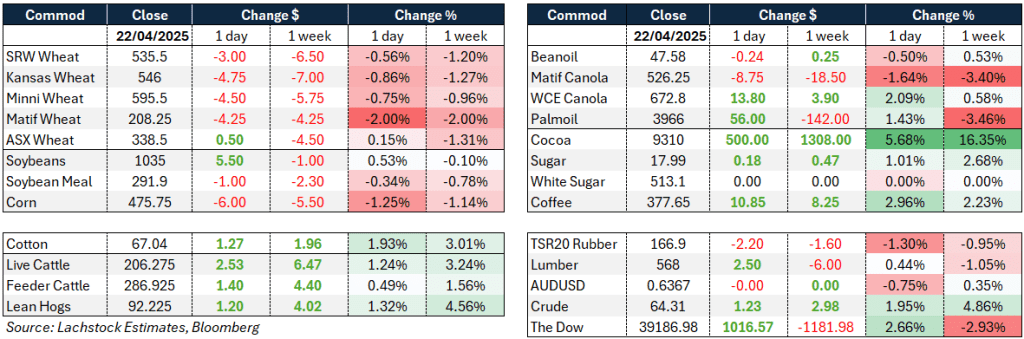

Offshore

Wheat – Wheat markets continue to struggle with weak demand despite stable global supplies.

Futures saw mild declines across US exchanges, while Matif wheat in Paris also fell.

MARS raised EU soft wheat yield forecasts by 8pc, signaling a 17m ton year-on-year production increase, though northern Europe remains dry.

Russian wheat prices stayed flat, with rains favoring only northern regions.

US HRW areas may see improved moisture in the next fortnight, and U.S. SRW conditions remain mixed, with excess moisture in some areas and dryness in others.

The launch of competing spring wheat contracts by CME and MIAX is creating a turf battle, with liquidity concerns if both persist.

Morocco forecasts a 41pc year-on-year rise in grain production, including 2.4m tons of soft wheat.

EU soft wheat exports are down significantly from last year, reinforcing the broader theme of tepid global demand.

Officials from the Iranian ministry of agriculture said on Sunday that the country’s wheat harvest could amount to 9-11 million metric tons (mt) this year, down from the 16 million mt reported last year.

Other Grains and Oilseeds – Corn futures dropped as US planting progress outpaced expectations, now at 12pc vs. 11pc last year. Good planting weather in most of the Midwest and favorable conditions in Brazil and Argentina reinforced bearish sentiment. Brazil’s national supply forecaster increased its corn estimate by nearly 2 MMT, and Argentina is seeing improved quality as rains ease.

Persistent export demand is helping the corn market avoid deeper losses.

Soybean futures firmed slightly, supported by export inspections up 24pc year-on-year and a weaker dollar.

Despite optimism over old-crop demand, future pricing remains uncertain, especially with record yield speculation.

ADM announced the closure of its Kershaw soy crush facility amid broader biofuel demand uncertainties.

Malaysian palm oil futures ticked higher after recent declines, helped by bargain buying.

EU barley exports are down 20pc year-on-year while corn imports are up 12%.

Macro – Macro pressures center on trade and monetary policy uncertainty. Trump reiterated criticism of Fed Chair Powell but denied plans to remove him, urging faster rate cuts. Despite pressure, the Fed has held rates steady to contain inflation, which has stayed above target for four years.

Bloomberg Economics projects Trump’s tariffs could cut $2 trillion from global GDP by 2027. 2025 growth forecasts were revised lower globally (to 2.7pc) and for the U.S. (to 1.3pc).

Trade talks with Thailand and Mexico remain unresolved, while disputes with Japan over rice tariffs and broader friction with China add to the uncertainty.

Treasury markets showed muted reaction to the ongoing rate and tariff narratives, though two-year yields rose slightly. US policymakers continue to weigh how tariffs, deregulation, and fiscal shifts will impact inflation, growth, and the labor market heading into mid-2025.

Australia – Not much changed to start the week in WA with canola bid $850 for new crop and GM $755. Current crop barley was bid $345 and wheat $360.

In the east of the country, bids were lower to start the week with not much appetite from the trade. Current crop canola was $775 with new crop $806. Barley was $336 and wheat $346.

Chickpea bids have made above $1000 again — bid $1020 delivered Brisbane for current crop and $880 for new crop.

Rainfall is filling in a little more for Victoria with 25mm for most of the state over the next week; same for NSW, which will be an ideal start for those working through their seeding programs.

The EYCI has rallied over the last month, with the indicator currently around 700c, supported by good pasture growth through southern QLD and northern NSW on the back of the widespread rains last month.

HAVE YOUR SAY