Weather: Showers in the US Central and Southern Plains remain limited, offering only partial relief for developing wheat, while heat in drier areas is unfavorable. Some improvement is expected with weekend rain. SRW wheat in the Delta and Midwest remains impacted by slow-receding floods, with ongoing rainfall likely to extend issues. The eastern Black Sea region saw recent showers but soil moisture remains below normal. Europe continues to benefit from passing systems delivering favorable moisture. Northern Africa has seen better rainfall for wheat fill, though drought persists, particularly in Morocco. China’s winter wheat is generally pretty good, although more rain would help.

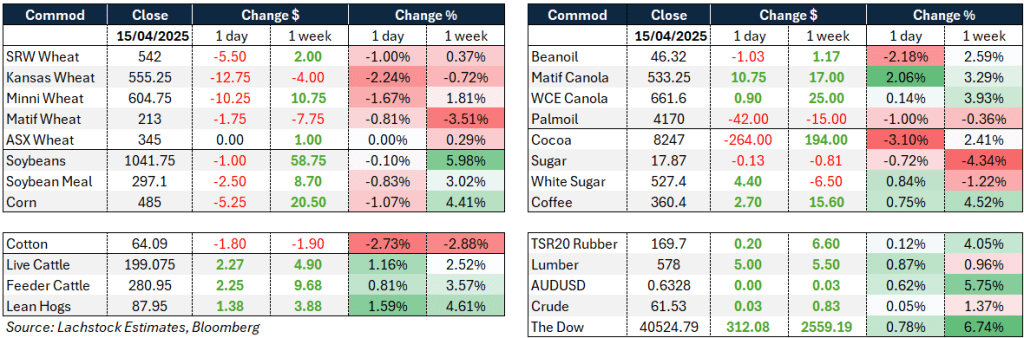

Markets: Markets puked out Fridays rally amid more talk of lackluster demand. The last two weeks have been nothing short of amazing from an outside market perspective. AUD digesting the Fed comments which map out 2 different paths from a rate perspective which will drive AUD – still fells like AUD rallies are capped due to China fiscal outlook.

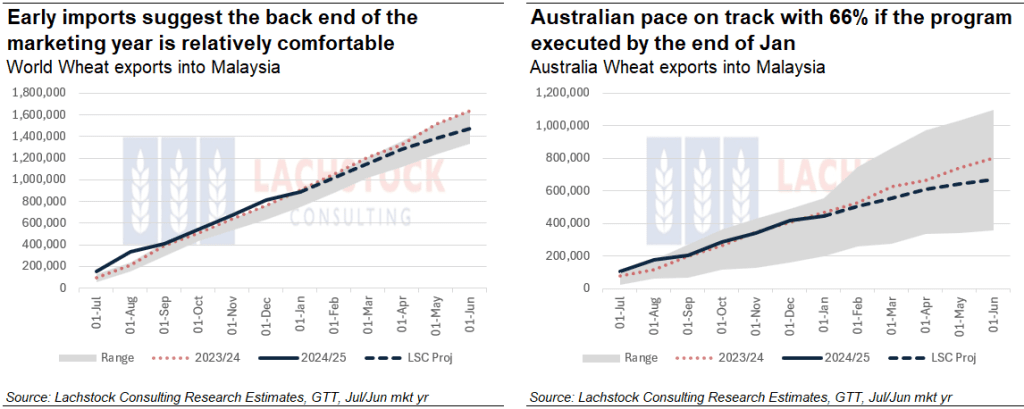

Australian Day Ahead: Australia is still competitively priced from an export perspective into Asia but we have lost some ground due to the AUD rally. Global rhetoric re demand doldrums are not necessarily reflected in import pace by our main Asian customers. The likes of Malaysia and the Philippines are ahead of required import pace to hit targets.

Offshore

Wheat – Argentina’s Buenos Aires Grain Exchange forecasts a 2025/26 wheat crop of 20.5 million tons, already set to be the second largest on record. An extension of temporary export tax cuts may lift estimates even higher. Recent policy changes, including a reduction in wheat export tax from 12% to 9.5% and a freer-floating peso, have encouraged exports by improving farmgate returns.

Meanwhile, in the U.S., beneficial rain and warming temperatures across the Southern Plains have improved conditions for winter wheat, pressuring prices lower. Wheat futures fell 1% on the day.

French farmers likely planted 4.63m hectares of soft-wheat for the coming season, the country’s agriculture ministry said in a Tuesday report. That’s above a February estimate for 4.57m hectares of winter soft-wheat, and would be 10% higher y/y

Other grains, oilseeds – U.S. corn plantings are set to reach 95.3 million acres in 2025, one of the largest on record, driven by strong relative profitability. Despite the increase, modelling suggests the larger acreage mix—particularly from lower-yielding states—will have a minimal effect on national yield potential, which analysts expect to average near 176.5 bpa.

USDA’s Crop Progress showed a slow planting start, with only 4% of the corn crop planted—below average—with Texas leading at 63%.

Corn futures dropped 0.9% on the day.

Soybean futures also fell 0.6%, weighed down by escalating trade tensions with China. China has halted new Boeing jet purchases and reduced U.S. soybean imports, reportedly bringing in only 3.5 million tons in March, the lowest in 17 years. This reinforces concerns that China may lean more heavily on Brazilian supply. U.S. soybean traders remain cautious as the trade war pressures demand.

Macro – Trade uncertainty continues to loom. Financial markets have stabilised, but further tariff risk is emerging as the U.S. probes whether imports of semiconductors and pharmaceuticals pose national security threats.

The slow progress on EU and China trade talks underscores the persistent tension. The Trump administration insists that China initiate negotiations, with the President stating “China needs to make a deal with us.” China, however, has retaliated by imposing a 125% tariff on all U.S. goods, escalating the standoff.

The impasse has extended to aviation, with China cancelling Boeing orders. While some tariff relief has been temporarily granted to U.S. allies, talks remain fragmented and inconclusive.

Meanwhile, Argentina’s broader economic policy shift—including a floating currency and calls for longer-term export tax reform—is being closely watched by ag markets for its potential trade implications.

Australia – Canola firmer by $5 yesterday through the west, with current crop $806 and new crop $845 with GM $710 and $750. Cereals unchanged with current crop wheat $366 and barley $348.

In the east of the country bids were largely unchanged, with current crop canola bid $760 and GM $680. Wheat was $348 and barley $330.

Reports suggesting more canola hectares to be cut out of the rotations through SA, Vic and SNSW as the planting window continues to close and dry conditions persist. Early estimations are a 10–20% reduction in canola planting through the Port Kembla port zone.

Export pace is strong despite a subdued China — 60% of LSC forecast 24/25 wheat exports being done Oct–Apr and 68% of barley exports.

Planting conditions in the south have feed mills keen to get some new crop cereals on the books with Murray Bridge and Wasleys new crop wheat bids around $385 and ASW delivered Melbourne $378.

HAVE YOUR SAY