Weather: Russian wheat regions have seen 30-40mm since the end of March – a good result given the deficits leading up to that point. Forecast turns hot and dry for the next 2 weeks and needs to be watched. Germany dry with little on the forecast. US is the 3 bears – too wet in some areas, too dry in others – spot fires need to be watched but not enough to force values higher at the moment.

Markets: The last two weeks have been nothing short of amazing from an outside market perspective. AUD digesting the Fed comments which map out 2 different paths from a rate perspective which will drive AUD – still feels like AUD rallies are capped due to China fiscal outlook.

Australian Day Ahead: Australia is still competitively priced from an export perspective into Asia but we have lost some ground due to the AUD rally. Global rhetoric re demand doldrums are not necessarily reflected in import pace by our main Asian customers. The likes of Malaysia and the Philippines are ahead of required import pace to hit targets.

Offshore

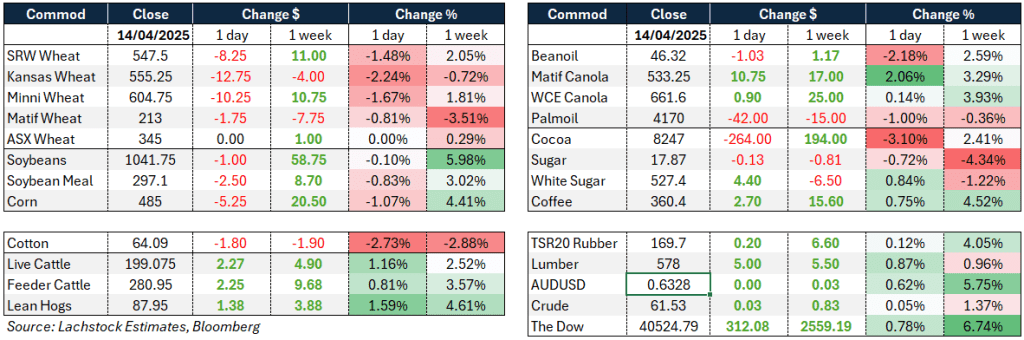

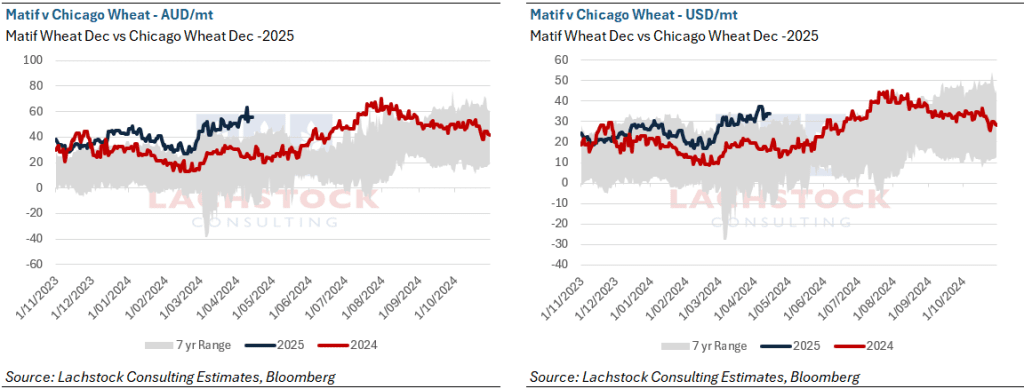

Wheat – Wheat futures weakened with WK down 8.25c, KWK off 12.75c, and MWK losing 10.25c. KC gave back prior gains while Chicago and Minny posted inside days. Matif May fell €4.00 and Russian cash held steady at $250.

US wheat inspections came in at 604.6k, above expectations and up 14.4% year-on-year.

Despite near-term demand weakness, dryness in the Black Sea eastern area and the risk that forecast rains in HRW miss key growing zones are supportive.

A major freeze in Turkey, reportedly the worst since 2014, may have damaged crops but assessments will take time.

Algeria stated it would be self-sufficient in durum wheat this year.

Russian wheat stockpiles have fallen sharply, down 33% year-on-year to 9.78 MMT as of April 1. The Russian government will raise its wheat export duty from April 16 to 2,210.1 rub/mt.

Ukraine’s 2025 wheat harvest is expected at 21.5 MMT, with spring wheat planting delayed by cold and snow, though officials say it’s not critical.

Dryness for the next 2 weeks in Russia and parts of the HRW are really the only two spot fires – they could become meaningful but demand, or lack of it, is driving the bus today

Other grains, oilseeds – Corn futures eased back after last week’s strength, with CK down 5.25c and CZ slipping 1.5c.

A sharp Argentine peso devaluation and remarks from President Milei urging growers to sell before export tariffs increase may trigger more near-term corn offers, potentially challenging US export competitiveness.

Still, US corn demand remains strong, with inspections at 1.83 million tonnes, the second-highest of the year and up 30.5% from last year.

China’s corn import forecast was revised down by JCI to 4.5 MMT from 7 MMT, below USDA’s 8 MMT estimate. Russian corn reserves also slipped slightly, down 0.9% to 2.26 MMT.

Ukraine’s 2025 corn crop is projected at 29.2 MMT, 18% higher than 2024, with exports potentially reaching 24.5 MMT.

Soybean futures saw mixed performance with SK finally settling lower after five straight gains, while SX rose again.

Soymeal and soyoil were weaker, leading to a notable decline in the May crush margin.

Argentine grower selling, nudged by economic policy changes and FX moves, weighed particularly on the product side.

US soybean inspections were 546.3k, tracking 10.8% above last year. China remains fully focused on Brazilian supply at this time of year. However, March soybean imports into China were just 3.5 MMT, the lowest for that month since 2008. For Q1, Chinese imports totaled 17.11 MMT, down nearly 8% year-on-year.

Argentine soybean harvest progress faces delays from heavy rains, though drier weather is forecast.

Russian oilseed stocks rose 1.1% to 3.13 MMT overall, but sunflower seed reserves were down 20.8% year-on-year.

Macro – Volatility in global markets continues to be driven by US trade policy. Federal Reserve Governor Waller outlined two tariff scenarios: a high, prolonged tariff regime, or a negotiated outcome settling around a 10% rate. In the first case, Waller anticipates a recessionary drag and would support earlier and deeper rate cuts. In the second, a limited monetary policy response would suffice given the temporary inflation effects.

Trump announced temporary exemptions for some consumer electronics, easing immediate trade tensions and lifting risk sentiment.

The S&P 500 rose 0.8%, Euro Stoxx 50 gained 2.6%, and the 10-year US Treasury yield fell 8.2bps to 4.38%.

The Australian dollar strengthened for a fourth straight day to 0.6300, helped by the tariff reprieve and a rotation out of USD assets. However, upside may be capped by broader macro uncertainty and Chinese demand concerns.

Crude oil held steady as markets balanced Trump’s exemptions with bearish demand sentiment. OPEC cut its demand forecast for 2025 and 2026, and Kazakhstan continues to overproduce, undermining quota discipline. The US EIA also revised down its 2025 demand growth forecast by 30% to 900kb/d.

Goldman Sachs projects large surpluses in 2025 and 2026, further pressuring prices. Brent remains down 13% this year.

The US has warned shippers and refiners in Asia to expect more enforcement around Iranian crude exports. Meanwhile, Trump’s administration hardened its trade stance with a ban on Argentine beef imports, as part of a broader America-first agenda. The move poses a challenge for President Milei, who has supported Trump’s ideology but now faces increased trade friction with the US.

Australia – Slightly softer across the board in the west yesterday, with an improving Aussie dollar pulling bids lower. Canola was bid at $840 for new crop and $750 for GM. New crop wheat was $377, with barley at $335.

In the east, canola improved to start the week with bids at $763 and GM at $690, with new crop $800. Wheat was bid at $350, with barley at $336.

New crop wheat bids for Murray Bridge and Wasleys for Jan+ are around $380, with current season at $385 for Murray Bridge. Barley is bid at $350–360 into major end users in SA.

Liquidity has been mixed for wheat and barley through the east. Improved liquidity early last week, but that tightened up quickly with dry conditions slowing selling.

Through the west, liquidity is strong with a good start to the 25/26 season and growers happy to continue selling.

The National Mutton Indicator rose 26% last week reaching the highest levels since July 2022, with strong demand and reduced yardings.

HAVE YOUR SAY