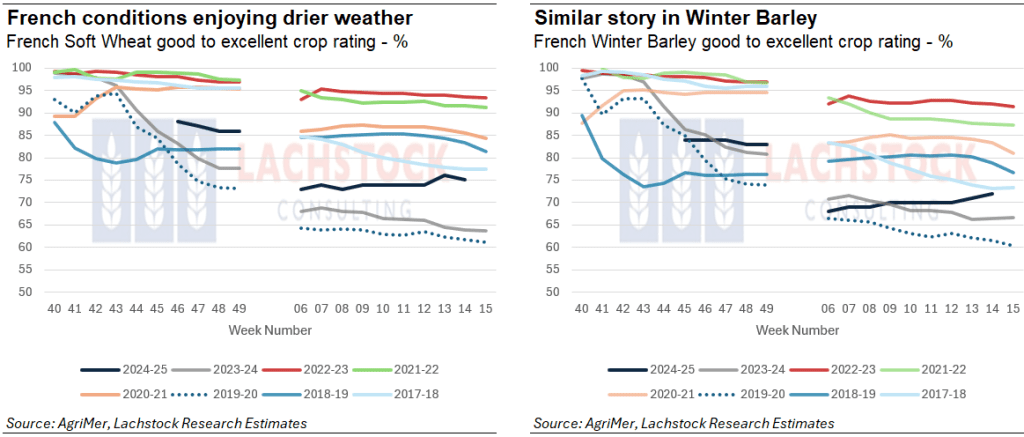

Weather: Wheat conditions remain mixed globally. The US Plains saw limited showers with heat stressing dry areas, while SRW wheat in the Delta and Midwest continues to face flooding and ongoing rainfall risks. The Black Sea and northern Africa received some beneficial rain, but soil moisture deficits persist, especially in Morocco. Europe is experiencing favorable rainfall, and China’s wheat is greening under mostly good conditions.

Markets: Markets feel exhausted. The end of the week it felt like the commodity markets simply traded USD weakness after a week from hell. Outside market noise will dominate the landscape and, with the exception of the odd spot fire, global weather isn’t given any real direction.

Australian Day Ahead: Aussie firm, but we are still the cheapest show in town. Does the Asian consumer show up in any fashion – they have been rewarded for hand to mouth buying so far so hard to see them changing tact.

Offshore

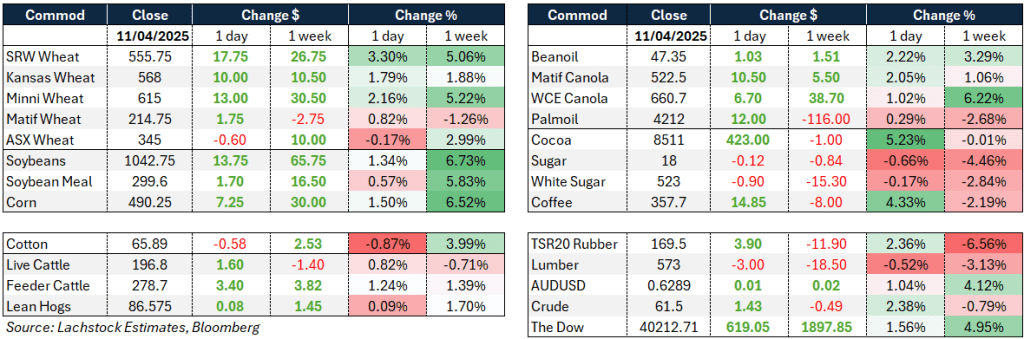

Wheat – In wheat, markets staged a strong rebound following a bearish WASDE report that had increased US HRS and HRW ending stocks by a combined 42 million bushels and reduced Chinese wheat imports to just 3 million metric tons.

Futures responded with solid gains: WK rose 17.75 cents, KWK added 10 cents, and MWK gained 14.5 cents. Paris Matif futures were also firmer, while Russian cash wheat softened by $1 to $250.

Contributing to the rally was a sharply weaker US dollar, which helped trigger short covering in a market with heavy speculative positioning.

Chicago wheat was also seen as cheap relative to corn and competing origins, currently around $46 per metric ton below French wheat.

Fundamentals in SRW remain tighter than HRW, with projected new crop carryout for SRW at 84 million bushels compared to 400 million for HRW. Recent excessive rainfall throughout the SRW belt may start to tighten estimates further.

Weather concerns added further fuel to the move, with dryness emerging in the Black Sea region, hail damage reported in Russian wheat areas, and persistent wetness in U.S. SRW regions countered by dryness in HRW territory.

Other grains, oilseeds – For corn and soybeans, both posted their biggest weekly gains in nearly two years, with corn futures rising 6.4 percent and soybeans up 7.8 percent.

The USDA raised its corn export forecast citing competitive U.S. pricing, particularly attractive in Asia where Gulf and PNW values are the lowest globally.

There is growing speculation that Thailand may reduce tariffs on U.S. corn, potentially unlocking 4 to 5 million metric tons of demand.

Soybeans were boosted by the USDA’s upward revision of domestic crush by 10 million bushels, driven by strong demand for soybean meal and oil. May crush margins improved to 137.25 cents.

Chinese buyers remained active in the Brazilian market, reportedly booking over 60 cargoes this week, yet U.S. sales also ticked up, with 121,000 tons sold to “unknown destinations” — a label often associated with Chinese purchases.

Additional strength came from a short-covering rally in meal and expectations that larger mandates could soon support soybean oil.

In cotton, futures were pressured after the USDA cut export projections by 100,000 tons and increased ending stocks, reflecting lower Chinese demand due to tariffs. Some U.S. growers are reportedly considering switching out of cotton into other crops. Planting conditions across the U.S. are warm and dry, allowing early progress in row crops but limiting wheat plantings in parts of the country.

Macro – On the macro front, US-China trade tensions escalated sharply as the US raised reciprocal tariffs on China to 125 percent, pushing the total tariff burden to 145 percent. China retaliated by increasing its own tariffs on U.S. goods to 125 percent as well. While this may mark a ceiling for retaliatory action, it has also created a stalemate with no clear path to resolution. A temporary exemption was announced late Friday for smartphones, computers, and popular electronics, but President Trump emphasized this was only a procedural step, with those goods to be moved into a separate sector-specific tariff regime.

The administration is preparing new levies under Section 232 focused on semiconductors and electronics, which are likely to carry different — potentially lower — tariff rates than the blanket 125 percent, but may prove more durable in the long run. The tariff shift offered a brief reprieve to companies like Apple but is unlikely to represent a broader rollback.

Crude oil markets swung wildly throughout the week, ultimately finishing lower as global recession fears intensified following the tariff announcements. A brief relief rally occurred after Trump announced a 90-day pause on some levies, but overall sentiment remains cautious.

OPEC’s plan to accelerate output hikes and a reluctance among U.S. producers to drill below $65 per barrel has added further complexity.

Meanwhile, a falling US dollar index helped support commodities more broadly, making U.S. exports more attractive. Analysts noted that end users were stepping in to lock in coverage amid tightening US supply outlooks, and fund managers began to take a closer look at grain and oilseed markets.

The broader farming community remains concerned about the longer-term damage from trade disputes, especially in soybeans and cotton. The American Soybean Association warned that more farm closures could follow if tariffs persist into next season.

Australia – In the west of the country new crop canola ended the week unchanged bid $845 with GM $740. Wheat was softer $379 and barley $338 vs current crop $355.

Through the east canola was firmer with new crop bids $795 and old crop $745. Wheat was bid $345 and barley $330 for current crop.

Some convergence in rainfall models over the next 14 days showing parts of SA through the Mid North and Southeast potentially getting 20-40mms with falls into western and central Victoria as well.

Exports continue at a strong pace through Vic and SA, with 81pb and 70pc of the LSC forecasted exports completed by the end of April for each state respectively. WA currently sits at 57pc, NSW at 53%, and Qld at 39pc, with 59pc of forecast national exports completed through Oct–Apr.

HAVE YOUR SAY