Weather: The market had time to drill into the conditions report with around 25 percent of the US production getting mild to large downgrades; at the same time, the expected freeze in the Plains and central US flooding added some support. The Russian forecast turns dry for the next 14 days while a slab of the EU is actually enjoying drier conditions to get spring crops in the ground.

Markets: Trump has imposed tariffs, countries react by imposing tariffs on the US, and the US then imposes more tariffs.

Australian Day Ahead: An AUD below 0.60 makes us very competitive but the Asian consumer needs to show up. Our biggest export competition on wheat comes from within. East coast and west coast bulk handlers are the ones smashing each other, not our usual other origins.

Offshore

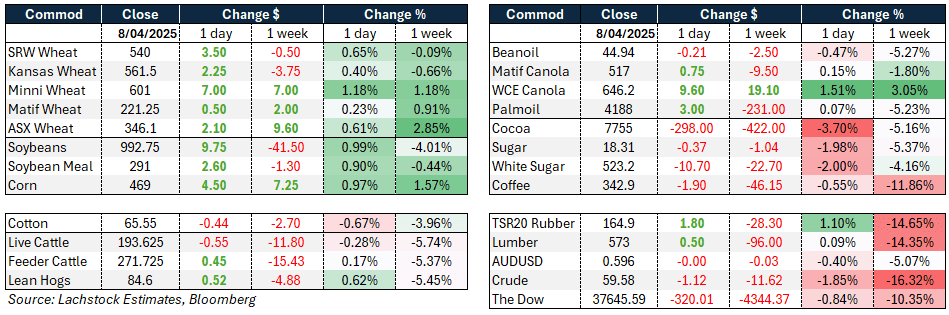

Wheat – Wheat futures rose for a second consecutive day, with Minneapolis May leading the way, up 7c, Chicago up 3.5c, and Kansas up 2.25c. In global markets, MATIF September futures gained €0.50/t while the May contract was unchanged. Russian cash values remained stable at $252/t.

An early rally in US wheat faded but later regained strength, led by Minneapolis. Crop conditions are becoming a greater market focus as the US winter wheat crop is now less than 50pc rated good to excellent, worse than last year’s levels. States such as Kentucky, Arkansas, and Tennessee posted significant condition declines, with KY down 48 points. These states, along with Missouri, account for approximately 27pc of the Soft Red Winter wheat crop. Freezing weather in the Plains and central US flooding have also added support to prices.

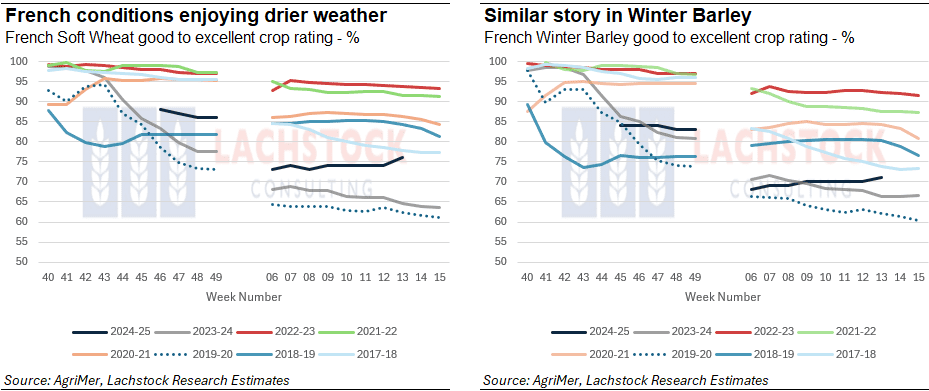

In Europe, France’s wheat crop remains in better shape than a year ago, though northern Europe has been dry recently. Recent rainfall in Ukraine could be beneficial, and Argus has kept its production forecast unchanged.

In trade, South Korea’s NOFI purchased 65,000t of feed wheat at $263.49/t C&F. The deal excluded origins like Russia, Argentina, Pakistan, Denmark, and China. Despite broad-based concerns over trade tensions, wheat markets have been somewhat resilient, with attention still centred on weather, crop structure, and overall demand.

EU soft wheat exports have totaled 16.4 million tonnes (Mt) so far this season, well below the 25Mt at this point last year. Nigeria, Morocco, and Algeria are the top destinations.

Other grains, oilseeds – Corn saw support from a surprise daily sale of 240,000t of old crop to Spain, lifting Chicago May futures by 4.5c, while December slipped slightly. The purchase was the first flash sale to Spain since June of the previous year.

In Brazil, the safrinha corn crop is approaching the reproduction stage and will need consistent rainfall through May. Crop forecasts vary slightly, with Cordonnier holding steady at 122Mt, while Bloomberg survey estimates range from 122Mt to 126.9Mt.

Barley exports from the EU are down 19pc year on year at 3.91Mt. Corn imports into the EU are up 13pc yoy, totaling 16.21Mt.

In soybeans, the current vs new-crop dynamic was also in play. Chicago May futures rose 9.75c, while November declined by 3.25c. CIF basis levels were thin but improved due to a rush of non-China demand.

In Brazil, Chinese interest has been strong, but recent grower selling pushed down cash prices. Cordonnier held his estimate for Brazilian soybean production at 169Mt, with Argentina at 48Mt. Other sources pegged Brazil slightly lower at 167.8Mt. Soymeal prices rose $2.60 on short covering, while soyoil slipped despite renewed bipartisan support for stronger biofuel mandates.

Palm oil also rallied off recent lows, boosted by gains in soybean oil and energy markets.

Macro – Tariff developments dominated macro headlines. President Trump confirmed the US will move forward with 104pc tariffs on Chinese goods, alongside 10-50pc tariffs on about 60 other nations. China responded forcefully, promising to retaliate and calling the US approach coercive and unilateralist. China is reportedly considering tariffs on US farm goods and a ban on Hollywood films.

At the same time, over 70 countries have approached the US seeking trade talks. Trump said many countries were offering concessions, and the administration claims $4 trillion in new investment has flowed into the US as a result of the tariff regime.

The EU plans to impose 10-25pc tariffs on select US goods, with some tariffs delayed and soybeans excluded until December. India, on the other hand, will not retaliate, hoping to finalise a favorable deal with the US. Trump claimed tailored trade deals are in progress and named Japan and South Korea as countries likely to reach agreements soon. Italy and Israel are also in discussions.

Markets initially rallied on hopes of deals, but those gains reversed as the White House doubled down on its tariff strategy. The S&P 500 fell 1.6pc, nearing bear territory, and the Nasdaq 100 remains firmly in a bear market.

Treasury yields fell sharply, with the 10-year dropping below 4pc. In contrast, bond yields in Germany and Japan have risen this year, making them relatively more attractive to hedged investors.

Chinese Premier Li Qiang expressed confidence in China’s ability to manage external shocks and called for renewed cooperation with the EU.

Meanwhile, US Agriculture Secretary Brooke Rollins said she expects new trade deals could be announced by the end of the week. US Trade Representative Jamieson Greer defended the tariff strategy before the Senate, stating it was “already bearing fruit,” though bipartisan scepticism and legislative efforts to curb Trump’s authority continue to grow.

Australia – Yesterday saw new-crop canola bids reach $872 in Western Australia, with GM at $750. New-crop wheat was bid around $383, and barley was $345 for new crop and $367 for current crop.

In eastern Australia, non-GM canola was bid at $785 and GM at $705, with new-crop canola at $810. Wheat was unchanged, bid at $345, and barley at $330.

New crop chickpea bids are beginning to be published, with growers having a full moisture profile and confidence in the year ahead. Delivered Brisbane bids are around $870, with current crop at $950.

Delivered Darling Downs wheat is trading around $357 for current crop and $370 for new crop, with current-crop barley at $340. It’s been a strong start to the week across the country with a 60c Aussie dollar working bids higher.

HAVE YOUR SAY