Markets: China retaliated hard – seems crazy, particularly on things like soybeans which they can’t do without.

Australian Day Ahead: ClearGrain has been active today, lots of offers being hit.

Offshore

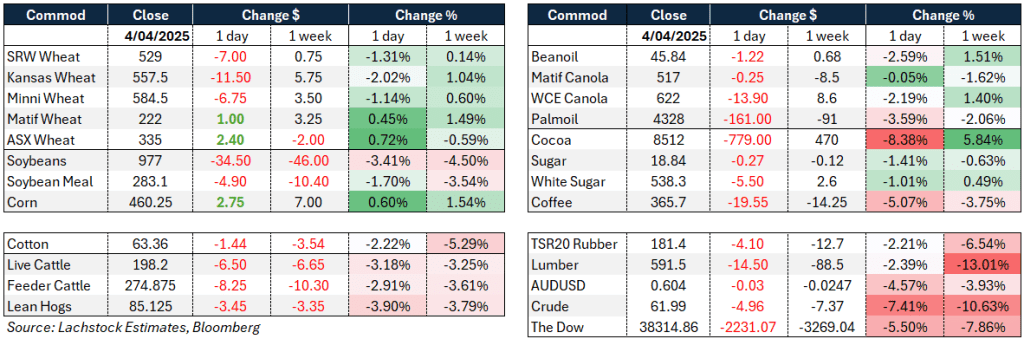

Wheat – US wheat futures remained under pressure amid escalating trade tensions and weak market sentiment. Chicago May dropped 7 cents per bushel, Kansas fell 11.5c, and Minneapolis lost 6.75c. Kansas wheat was particularly soft, although spreads in Chicago and Minneapolis held firmer. Implied volatility in Chicago May closed at 29.94 percent. Traders noted US wheat, especially Soft Red Winter, is looking cheap and may be factoring in broader risks such as a possible vessel tax.

Positioning shows shorts continuing to build, with the all-wheat short nearing historic levels. In Europe, the MATIF wheat market appears heavily short, with the May/September inverse now at €4.50/t, suggesting a tougher roll than seen previously and a potential inflection point in Paris.

French soft wheat conditions showed modest improvement to 76pc rated good to excellent, up from 74pc, aided by recent dry weather after earlier rainfall had disrupted planting.

India is forecast to harvest a record 115 million tonnes of wheat in the 2025-26 marketing year, driven by favorable growing conditions and strong price incentives

Other Grains & Oilseeds – Corn was mixed. Chicago May initially rallied, jumping 10c from low to high before finishing up 2.75c. CNZ gained 2.5c. China’s tariff impact was less severe for corn due to low trade volumes, only around 3Mt versus 22Mt of soybeans.

The market sees potential opportunity with Vietnam, forecast to import 13Mt of corn, mostly from South America, but traders see US corn as competitively priced globally.

Weather is a concern for US corn planting: forecasts show heavy rains could delay seeding and cause replanting in some areas.

Brazil’s corn exports rose 104pc year on year in March, while USDA sees 2025-26 production at 130Mt, up from 126Mt, though still below the 2022-23 record.

Argentina’s corn harvest is 20.3pc complete; production is estimated at 39Mt. Frost risks in Buenos Aires and La Pampa may impact yields.

Soybeans were hit hard by China’s retaliation. Chicago May sobyeans fell 34.5c, May soymeal lost $5.10, and BOK dropped 122 pts. May crush improved slightly, up 10.25c to 150. US soybean exports are vulnerable, given China is the largest customer.

Brazilian soybean premiums surged as US futures collapsed, highlighting the shift in global buying behavior.

Palm oil futures fell, dragged by weaker soyoil and crude, underlining the broader uncertainty in vegetable oils.

USDA’s export and crop progress reports are due next Monday and will be key in tracking export pace and planting delays.

Macro China imposed a 34pc tariff on US goods effective April 10, matching Trump’s 54pc tariffs on Chinese imports. The measures include restrictions on rare earths and specific US agricultural and defense firms.

The global market sell-off accelerated. Equities, commodities, and risk assets slumped, with fears of recession mounting. Economists warn of a self-reinforcing downward spiral unless negotiations resume.

Trump reiterated that tariffs are a tool for negotiation but defended their use despite a $2.5 trillion market loss. China’s retaliation and the EU’s pushback show growing global opposition.

The US job market surprised to the upside in March with 228k new non-farm payrolls, lifting the 3-month average to 152k. Services led the gains, while manufacturing remained stagnant.

US Federal Reserve chair Jerome Powell acknowledged downside risks from tariffs but emphasised the need to keep inflation expectations anchored.

CME Fed funds futures shifted: no change expected in May, but five 25bp rate cuts now forecast across the rest of 2025, which would bring the Fed funds rate to 3–3.25%.

Canada responded with a 25pc tariff on US-made cars violating USMCA rules. Canadian Prime Minister Mark Carney criticised the US for abandoning global economic leadership.

French President Emmanuel Macron and the EU signaled intent to halt US investment amid trade tensions. France continues to oppose the Mercosur trade deal without an “emergency brake” on farm imports.

Australia

Canola bids were softer in the west to end the week, down around A$10-$15/t, bid around $800/t for current crop and $855/t for new crop. Wheat improved to $376 for both current and new crop, with barley at $356/t for current crop.

In eastern Australia, canola bids were steady around $775/t, with GM at $690/t. New crop was bid $790/t. Wheat was unchanged on Friday, bid at $342/t, and barley at $320/t.

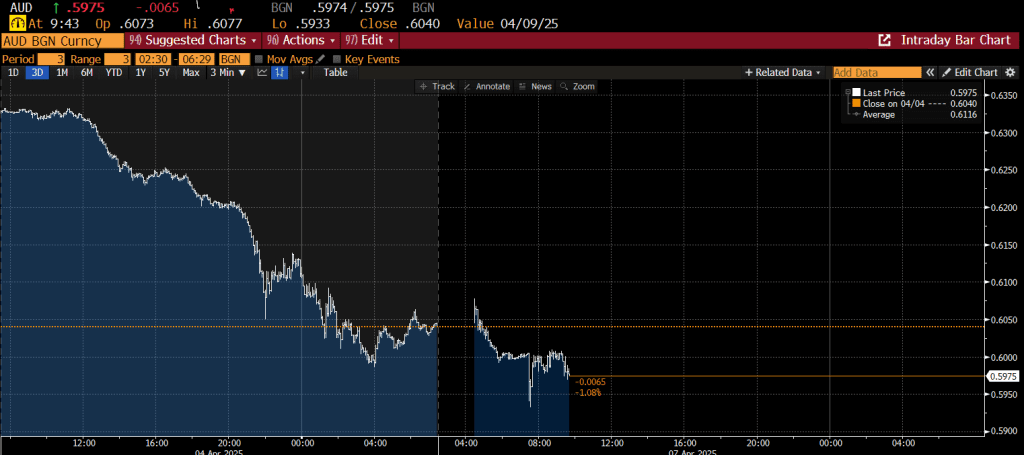

The Aussie dollar falling below 60c will be supportive of domestic pricing. It will be a surprise if the trade passes on the full extent of this move, with so much global uncertainty and what this will mean for Aussie grain demand from Asian homes.

The next week is set to remain dry for South Australia and Victoria, with growers now more nervously watching as Anzac Day fast approaches. Planting has begun through most regions in Vic and parts of SA.

HAVE YOUR SAY