Weather: Moisture is trying to work its way further south in Australia with now most of NSW likely to receive an inch over the next week with most parts forecast for 50-100mm. Rain is on the forecast for the Black Sea region and northern/eastern parts of the US Southern Plains- welcome news but still more rain will be needed in the short term.

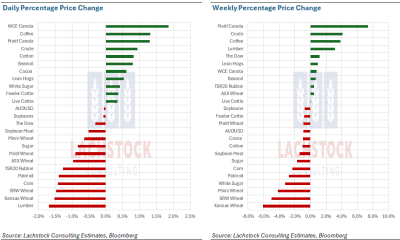

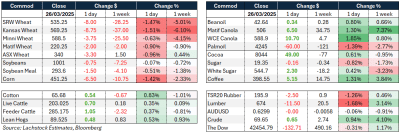

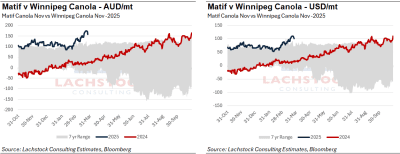

Markets: US wheat traded softer last night with Russian/Ukraine ceasefire weighing on market and an improving outlook with recent rains for SRW country. Global canola markets were higher with solid demand and diminishing stocks.

Australian Day Ahead: Canola should continue working higher after recent losses; expect GM Vic track market to get close to $700. Wheat and barley locally should deliver more of the same. Global markets are off, the weak Aussie dollar will take some of the sting out of it and local prices will continue to be supported by domestic demand.

Offshore

- March 1st grain stocks report next Monday with traders estimating 1.22bbu of wheat, 8.153bbu corn and 1.91bbu soybeans.

- Ukraine has exported 32.2 million tonnes (Mt) of grain this season, down nearly 6pc from last year, the Agriculture Ministry reports. As of May 31:

- Wheat: 12.9Mt (-4.4pc)

- Barley: 2.2Mt (+12pc)

- Corn: 16.6Mt (-10pc)

March exports fell to ~3Mt, down 33pc year-on-year.

- Jordan has issued a tender to purchase 120,000t of milling wheat from optional origins, European traders said Wednesday. Price offers are due by April 8.

- Analysts forecast 94.17 million acres of corn being planted by farmers this spring, up from 90.59 million acres projected in last year’s Prospective Planting report

- The average trade estimate for soybeans was 83.762 million acres, which would be down from 2024’s 87.050 million acres.

- EU soybean imports for the 2024/25 season, which began in July, totalled 9.84Mt as of March 23, 2025—marking a 7pc increase compared to the same period last year, according to data released by the European Commission on Tuesday.

- President Donald Trump has signed an executive order imposing a 25pc tariff on all imported vehicles, effective April 2, in an effort to stimulate US manufacturing and job creation. The administration estimates the tariffs could generate up to US$100 billion in annual revenue. However, the move is expected to raise car prices for American consumers by several thousand dollars and disrupt supply chains across North America. European carmakers such as Porsche and Mercedes-Benz could face losses of up to €3.4 billion, potentially heightening tensions in US-EU trade relations.

- The Moroccan government has extended its soft wheat import subsidy program through December 2025 in response to ongoing drought conditions that have severely impacted local agriculture. The country is experiencing its sixth consecutive year of drought, with wheat production expected to fall by 50pc in 2024. To offset the shortfall, Morocco has significantly increased wheat imports, particularly from Russia, which saw an 86pc year-on-year rise in November 2024.

Australia

WA canola bids were firmer yesterday on the back of global markets with conventional bid A$790 and GM bid $730. Wheat was steady $375 and barley $358 FIS.

In the east of the country canola worked higher bid $786 and GM $685. Wheat was firm $344 and barley $320.

With grower canola selling estimated to be around 90-95pc through the east of the country the next 1-2 months will be an opportunity to sell remaining stocks while the exporters have demand. There’s not enough seed left to encourage more vessels.

With Vic barley pricing at or around export parity and a need to encourage more tonnage from SNSW for domestic use the Vic market needs to work higher with the premium not currently there.

HAVE YOUR SAY