Weather: Most eyes today are on the Aussie weather with the majority of Qld to get +100mm rain this week, forecast is looking better every minute for NSW with 15-75mm for majority of the cropping belt. Let’s come back to global weather in a day or two.

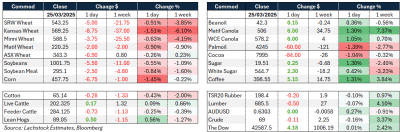

Markets: US Ag futures all fell around 1 percent overnight following the news of a partial Ukraine/Russia ceasefire agreement. Canola faired okay, with both exchanges up 1pc and the Matif nearby contract up 7pc across the past week.

Australian Day Ahead: Canola bids will continue to find strength domestically today expect bids to be A$5-10 stronger. Wheat slightly softer on the back of global markets. Barley largely steady with strong exports and domestic demand.

Offshore

The US announced that Russia and Ukraine have agreed to implement a partial ceasefire, stopping military force in the Black Sea to enable the safe passage of vessels. Russia said the US had agreed to help it lift restrictions on food, fertiliser and shipping companies in exchange for agreeing to a maritime security deal in the Black Sea. Russia and Ukraine agreed to work with the US on implementing a ban on military strikes on each other’s energy installations.

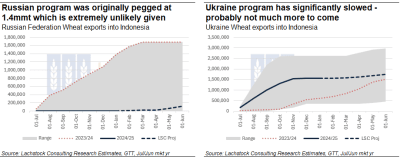

Wheat imports by Indonesia from Russia (left) and Ukraine (right). The contribution of each origin swapped from last year (dotted red line) to this year (solid blue line). Source: GTT via Lachstock. Click expand.

Soft wheat yields in the EU for the 25/26 season are forecast to be 6 t/ha, compared to 5.58 t/ha last season according to MARS, and rapeseed yield forecast is currently 3.2 t/ha for the new season, compared to 2.95 t/ha last year.

Japan will hold a tender to purchase 119.8kt wheat from the US, Canada, and Australia this week.

Brazilian agricultural consultancy AgRural reported the 24/25 Brazilian soybean crop was 77pc harvested, compared to 70pc last week and 69pc last year. It lowered the 24/25 production forecast from 168.2 million tonnes (Mt) to 165.9Mt. AgRural maintained its forecast for Brazil’s 24/25 second corn crop at 87.9Mt, taking total corn crop production estimate from 121.2Mt to 121.8Mt.

The USDA rated the Kansas winter wheat condition at 49pc good to excellent for week ending 23 March, a 1pc improvement for the week. Oklahoma’s winter wheat ratings were down 9pc across the week, to 37pc good-to-excellent.

Australia

WA canola bids were steady, with current crop conventional at A$790 and GM bids at $725, while new crop conventional was at $820. Wheat bids were $377, and barley was $358.

Through the east, canola bids were $5 stronger, with conventional at $783 and GM bids at $685. Wheat was softer, around $342, and barley was $320.

Faba bids for the current crop remain strong, around $660, and roughly $550 for the new crop, with early planting indicating increased faba hectares through NSW and Vic.

Some widespread rainfall is due for NSW over the next 10 days, which will give growers confidence leading into planting. WA, SA, and most of Vic are set to remain dry over the next two weeks.

HAVE YOUR SAY