Weather: Do not look at a weather map for Russia because, according to Russian Institute for Agricultural Market Studies, IKAR, 2025 production is actually going up. It raised the forecast to 82.5 Million tonnes (Mt) from 81Mt. The US Plains looks like it gets a dribble, as does Russia, but temperatures are all above normal so the extra moisture is not a crop-maker.

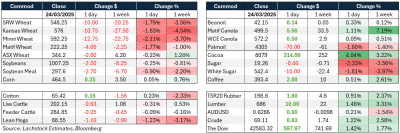

Markets: US futures felt the brunt of selling as the focus of every wire was on the demand side of the balance sheet. Additional bearish inputs like Donald Trump threatening to tax any bulk vessel made in China was not helping values.

Australian Day Ahead: Today is a tale of two halves. Rainfall projections for the north continue to grow, but there is very little rain forecast for Vic, SA and WA. Though it is early days, risk premium does need to be built unless we see a change in the weather pattern.

Offshore

Donald Trump is at it again. This time he levelled a double-barrelled attack on agricultural markets. The first was threatening an additional 25 percent tax on any nation purchasing oil and gas from Venezuela. The second, which drew steep criticism from US shipping companies, was threatening to impose steep port charges potentially over US$3m per call on vessels built in China. While the administration argues the latter move would counter China’s dominance in global shipbuilding and boost domestic production, industry leaders warn it would instead harm American-owned carriers that rely heavily on Chinese-made ships, shift cargo to foreign operators, and ultimately weaken the very demand needed to support US shipyards. With China now producing over half of the world’s ships and US yards turning out fewer than 10 annually, critics argue the policy risks causing more damage than growth.

Demand is driving value at the moment with little-to-no panic from the global buyers. This has allowed the spec short to push, not only flat price, but also structure with futures markets now reflecting wide carries. While this has been rewarded with the market coming back, it does create some challenging positioning if there is a supply side change.

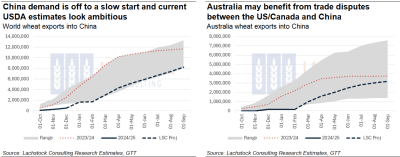

China still holds the key for global ag values and it is dragging its heels. The pace of wheat imports by China is about 5.5Mt behind previous year-to-date.

USD strength has been a feature for the last few days and is another bearish input into the wheat markets. Safe haven buying with the level of global volatility makes sense, just hard to have confidence in anything at the moment.

Wheat import demand by China. Cumulative monthly tonnes. Blue line represents current year. Dotted red line previous year. Source: GTT via Lachstock. Click expand.

Australia

WA canola bids were softer by about A$10. Current crop conventional was bid $765 and new crop $820. Wheat was steady, bid $377, and barley unchanged at $360.

Prices were firmer for canola in the east yesterday with conventional $765 and GM $685. Wheat was unchanged $345 and barley $322.

Despite global noise around canola, demand domestically is solid with SA/Vic/NSW exports to be all but done by Mar/Apr and very little carry out through these states. The container market remains strong with $710-$720 GM bids delivered Melbourne.

New crop canola bids delivered domestic crush through the east are $780-$800 currently.

HAVE YOUR SAY