TMA figures indicate tractor sales retreated to a more normal level after the boom years of 2021 and 2022. Photo: O’Connors

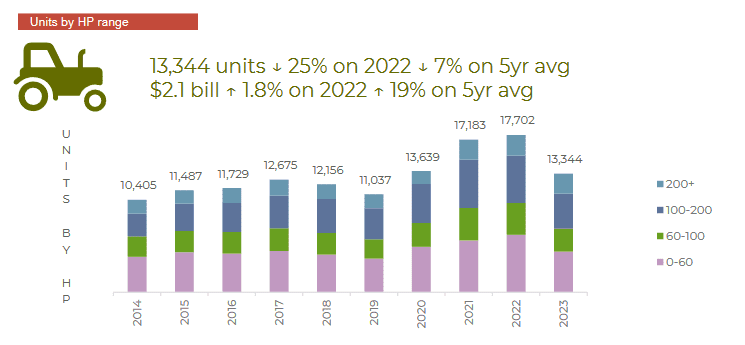

NATIONAL tractor sales in 2023 were down 25 percent from the 2022 figure, while combine harvester and header sales fell 7pc, according to figures released this week by the Tractor and Machinery Association of Australia.

Contained in its annual The State of the Industry 2023 Tractors and Machinery Report, the figures indicate what TMA executive director Gary Northover said was a return to normal sales levels after the unprecedented boom years of 2021 and 2022.

“All of this activity has been conducted against a backdrop of supply chain challenges ranging from shipping delays to component shortages, not to mention the ongoing challenges with staffing,” Mr Northover said in the report.

Total TMA figures include tillage, seeding, spraying and hay equipment, and some segments recorded year-on-year growth.

One of those was self-propelled windrowers, with total units sold at 122 the highest achieved since 2014, when 128 units sold.

The estimated total sales value of $5.9 billion was up around 5pc from the 2022 figure, with tractors on $2.1B, harvesters on $1.17B, and self-propelled sprayers on $756 million the three largest-value segments.

Overall value of new units sold has seen an increase of 1.8pc, which is driven by the distribution of sales by horsepower range decreasing in the lower ranges.

In tractors, the 200-plus HP range has experienced a decrease on last year of 5pc in terms of units sold and is the only HP range to experience an overall sales value increase.

Figure 1: Tractor unit sales by horsepower range. Source: TMA

The value of combine harvester and header sales increased by approximately 20pc overall.

This is driven by a 110pc increase in class 10 combine units sold and a 222pc increase in class 10 combine values. “

Classes 8-10 now account for 88.5pc of all combine units sold and 90pc of value, with class 9 and 10 being 52pc of the total value, up from 34pc in 2022.

“While data is not reported, the industry feeling is the self-propelled sprayer market saw growth, mostly in value,” the report said.

The tillage and seeding machinery segment market also improved, with sales estimated to have reached $510.6M, mostly from price increases.

TMA provides estimates on the combined value of sales of other key segments, including trailed sprayers, cotton and cane harvesters, self-propelled forage harvesters, and chaser and haul-out bins.

“Industry feeling is this has remained stable at $1.1B.”

Dry conditions in Queensland and New South Wales through the winter-cropping cycle appear to have impacted sales of combine harvesters, while sales in other mainland sales increased.

| HEADER SALES | 2021 | 2022 | 2023 |

| Qld | 71 | 96 | 59 |

| NSW | 366 | 341 | 236 |

| Vic | 183 | 197 | 215 |

| Tas | 1 | 3 | 3 |

| SA | 144 | 151 | 164 |

| WA | 316 | 357 | 379 |

| TOTAL | 1081 | 1145 | 1061 |

Table 1: Unit sales of combine harvesters and headers in 2022, 2023 and 2024. Source: TMA

Source: TMA

HAVE YOUR SAY