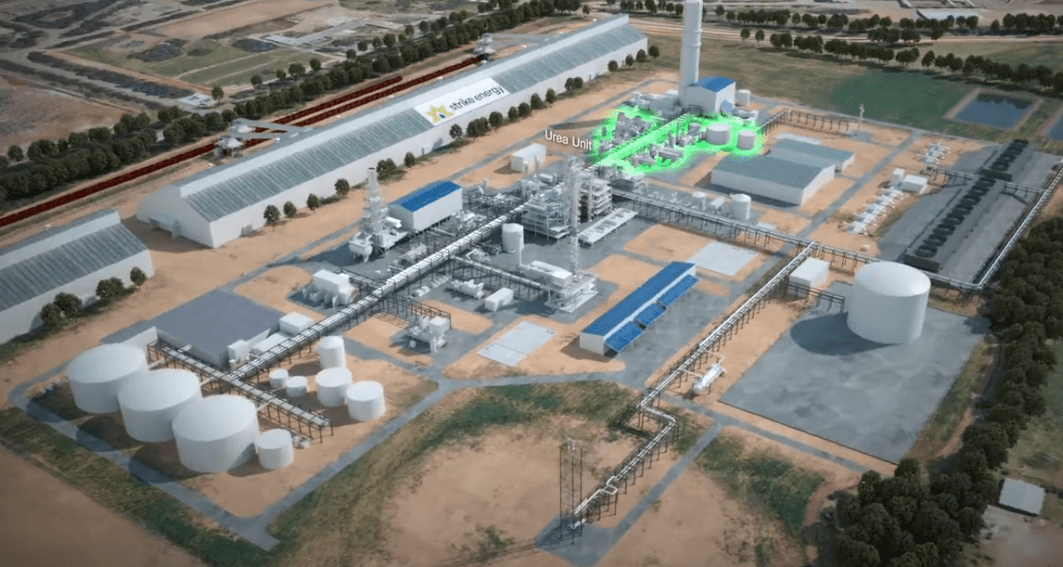

An artist’s impression of the proposed flagship NeuRizer Urea Project. Photo: NeuRizer

THE DREAM of largescale domestic urea production has suffered a setback, with Western Australia’s Strike Energy abandoning its Project Haber and South Australia’s Neurizer announcing indefinite delays to its Leigh Creek project.

Only Perdaman’s Karratha project looks to be on track with Abu Dhabi sovereign investor Mubadala Investment Company and Global Infrastructure Partners last month announcing a significant investment in the facility.

Touted as solution to high-cost imports, Strike Energy’s Project Haber was set to produce up to 1.4 million tonnes per annum of granular urea fertiliser.

Located under South Erregulla gas resources on a 3500-hectare land holding 350km north of Perth, the $3 billion plant was to produce “world class low emissions urea fertiliser” via a “combination of best-in-class technology, low impurity natural gas and the domestication of supply chains”.

However, the project appears to have been shelved after the company, on Monday, announced that it would transform the site into a peaking power station.

Strike Energy managing director Stuart Nicholls told shareholders that the company changed the “development project from a standalone domestic gas project now to a South Erregulla peaking gas power station”.

“We have made a submission to the [Australian Energy Market Operator] to capture the potential for an 85 megawatt power project to be developed on the precinct on Strike’s wholly owned 3500ha land parcel that sits above the gasfield,” Mr Nicholls said.

“The facility itself will commence electricity sales in October 2026.”

The decision was driven by the results of tests earlier this year which showed that there was lower than expected gas reserves at South Erregulla.

“Due to the lower expectation of the overall reserve that sits at South Erregulla…Strike is reviewing its development concepts at South Erregulla where we are looking to maximise the value of every and each molecule of gas that we have at that location,” Mr Nicholls told shareholders in February.

The announcement also presumably ends the non-binding term sheet agreement between Strike and Koch Fertiliser, announced in May 2022, which signaled the beginning of offtake negotiations for 100pc of the urea production.

Strike made significant strides towards progressing Project Haber, commencing Front End Engineering and Design (FEED) work and submitting environmental approval applications to the WA Environmental Protection Agency.

Strike has also announced delays with its West Erregulla project which it co-owns with Warrego Energy, and was forecast to supply 87 terajoules of gas from 2025.

As of December 2023, AEMO estimated the project will be delayed until at least 2027.

This project was also set to bring benefits for Australia’s fertiliser industry with CSBP in August 2020 signing an off-take agreement to purchase 25 terrajoules per day of gas produced from West Erregulla for 11 years.

An artist’s impression of Strike Energy’s Project Haber facility. Photo: Strike Energy

NeuRizer setbacks

SA’s NeuRizer has also suffered significant challenges progressing its long-promised urea plant (NRUP) to be located at Leigh Creek.

The ASX-listed company initially anticipated that the facility would produce 1Mt per annum of “carbon neutral urea” by 2026.

As of November 2023, NeuRizer was working towards finalising FEED work and the Bank Feasibility Study.

The company had also announced major offtake agreements, with Samsung C&T signing up to purchase an initial 100,000 tonnes per year, with options to increase to 300,000t, and DL Trading to buy 500,000t per annum.

However, NRUP progress took a significant hit when, in January, the company announced an unnamed potential strategic partner had pulled out of negotiations.

“They have stated that they are prepared to resubmit as the project progresses further,” NeuRizer said in a statement to the ASX in January.

“The company will continue to pursue other strategic partner opportunities but is now also working through the impact of these delays on the project, its funding and its timeframes.

“The company acknowledges that this will impact the timing of the Final Investment Decision for the project.

“However, the company is not in a position to provide revised timelines at this point.”

Also in January, NeuRizer announced the SA Government had ordered NRUP to receive further approvals under the Federal Government’s EPBC Act.

The Department of Climate Change, Energy, the Environment and Water agreed that the project should be assessed by an Environmental Impact Statement.

At the time, NeuRizer said there “was no legislative requirement for this referral” and that it was “reviewing its legal options”.

However, due to recent legislation changes, NeuRizer “decided the best course of action rather than challenge the original determination” was to progress through the EIS process.

NeuRizer executive chairman Justyn Peters

With no statutory timeframes associated with the process, NeuRizer executive chairman Justyn Peters told shareholders the project could be significantly delayed.

He said the added regulatory process and the absence of a strategic partner had created a difficult situation for the company.

“It doesn’t mean that the project itself is dead, it just means that the timelines have blown out completely,” Mr Peters said.

“You can do all these things and get yourself into a position and, in effect, you have the rug pulled out from underneath you.

“We have a lot of people who have supported us, and we owe it to them to remain focused and tireless to make this successful, and we will do it.

“I’m sure there will still be some pain to come as we move through the process to get there, but we are comfortable and confident that we are going to get there.”

In response, NeuRizer management have pulled back on expenditure to “maximise its financial position” including finalising the sale and leaseback of four diesel generators, relocating to a smaller office premises, workforce reductions, and pursing other asset sale options.

Perdaman funding injection

The only new production facility currently under construction, Perdaman’s $6.4B Project Ceres urea plant, appears to be going from strength to strength since works commenced in April 2023.

Last month the project received a boost with Mubadala Investment Company alongside Global Infrastructure Partners announcing an undisclosed investment in the facility.

“The investment aligns with Mubadala’s responsible investing mandate, supporting national and regional food security ambitions while reducing the carbon footprint of urea production,” Mubadala executive director of traditional infrastructure Saed Arar said in a statement.

“Building on our long-standing relationship with Global Infrastructure Partners, we are excited to support Perdaman on its impressive and sustainable growth – with a focus on delivering projects that bring benefits to local communities and mitigate the impact of climate change.”

Perdaman’s facility at the Burrup Strategic Industrial Area, 20km north of Karratha, is set to be the largest urea plant in Australia and one of the largest in the world, producing 2.3Mt of urea per year.

All of this output is destined for existing Australian fertiliser company, Incitec Pivot, who has an exclusive 20-year offtake partnership with Perdaman.

The plant is scheduled to start production in 2027.

Alongside the production facility, the site will feature water treatment and power plants, urea storage, unloading and loading infrastructure and a conveyer that will transport the urea to the Pilbara Ports Authority for shipping to local and offshore markets.

Uncertain benefits for growers

Following the shutdown of Incitec Pivot’s Gibson Island plant in late 2022, Australia has been wholly reliant on imported urea.

With production of about 300,000t per annum, Gibson Island only supplied approximately 15 percent of domestic demand.

GrainGrowers Fertiliser of the Future report estimated Australia imported 2.81Mt of urea in 2021, mostly from the Middle East and South-east Asia.

The report theorised that while Perdaman’s Project Ceres would “dramatically increase production of urea”, the single offtake agreement with IPL “may restrict the total benefit to growers in future”.

“This supply is to be split between domestic and export markets, with a likely preference for export,” the report said.

It said overall the project was unlikely to “see a meaningful structural lowering of the cost of urea domestically for farmers”.

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY